Reference no: EM13919307

1.Which of the following is an internal failure cost?

rev: 03_12_2014_QC_46491

Depreciation on testing equipment

Warranty replacement costs

Costs to rework defective units

Engineering and design costs

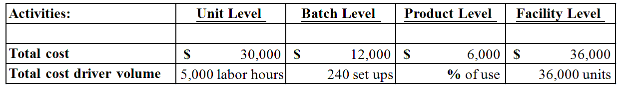

2. Rocoe Company produces a variety of garden tools in a highly automated manufacturing facility. The costs and cost drivers associated with four activity cost pools are given below:

Production of 10,000 units of a hand-held tiller required 1,000 labor hours, 80 setups, and consumed 25% of the product sustaining activities. Assuming the company uses activity-based costing, how much total overhead will be allocated to this tool?

3.Benitez Company makes wicker and wooden slat picnic baskets. It requires approximately 1 hour of labor to make one basket of either type. Wicker baskets are produced in batches of 100 units and require 0.5 machine hours per basket. Wooden slat baskets are produced in batches of 50 units and require 0.75 machine hours per basket. Setup is required for each batch. During the most recent accounting period, the company made 8,000 wicker baskets and 2,000 wooden slat baskets. Setup costs amounted to $24,000 for the baskets produced during the period. If activity-based costing is used to allocate overhead costs to the two products, the amount of setup cost assigned to the wicker baskets will be:

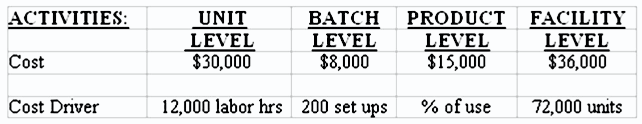

4. Valpar Company produces several lines of laundry hampers. The factory is highly automated and uses an activity-based costing system to allocate overhead costs to its various products. During the upcoming period the company expects to produce 72,000 units. The costs and cost drivers associated with four activity cost pools are given below:

Production of 20,000 units of its popular foldable hamper required 3,000 labor hours, 75 setups, and consumed one-third of the product sustaining activities. What amount of unit-level costs will be allocated to the product?

5.

Which of the following costs is likely to be driven by machine usage?

Factory rent

Factory utilities

Factory insurance

Depreciation on factory building

6.

Which of the following activity costs should usually be ignored when making a decision regarding whether to eliminate a product?

Batch-level costs

Facility-level costs

Product-level costs

Unit-level costs

7.

Which of the following is an activity-based cost driver?

Material cost

All of these answers are correct.

Number of machine setups

Machine hours

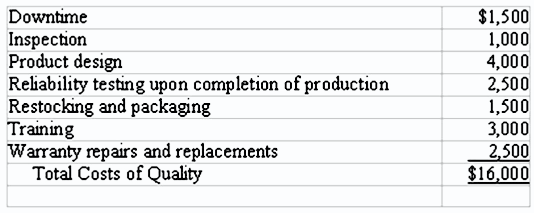

8. The Farber Company recorded the following costs of quality during the current period:

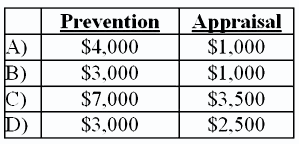

Which choice below represents the correct amount of prevention and appraisal costs?

Choice A

Choice D

Choice C

Choice B

|

Interest in minaj

: In January 2012, Wallace, Inc. acquired a 25% interest in Minaj, Inc. for $1,750,000, giving Wallace significant influence over Minaj. Any excess of purchase price over book value was considered goodwill

|

|

Fewest number of estimates

: Which budget has the fewest number of estimates-Purchases budget -Sales budget

|

|

Modern manufacturing companies

: What is the principal reason that direct labor hours is no longer an effective base for allocating indirect costs in many modern manufacturing companies-Movement from full-time to part-time workers

|

|

Diego company manufactures

: Diego Company manufactures one product that is sold for $73 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 56,000 units and sold 51,000 u..

|

|

Automated manufacturing facility

: Rocoe Company produces a variety of garden tools in a highly automated manufacturing facility. The costs and cost drivers associated with four activity cost pools

|

|

Competitive and price-sensitive

: Ultratech, Inc., manufactures several different types of printed circuit boards; however, two of the boards account for the majority of the company's sales. The first of these boards, a television circuit board, has been a standard in the industry fo..

|

|

Different blends of coffee

: Gourmet Specialty Coffee Company (GSCC) is a distributor and processor of different blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. GSCC currently has 12 different coffees that i..

|

|

Subsequently converts the property to rental property

: Tina purchases a personal residence for $278,000, but subsequently converts the property to rental property when its FMV is $275,000.

|

|

Shares of corporation

: Monte inherited 1,000 shares of Corporation Zero stock from his father who died on March 4 of the current year. His father paid $30 per share for the stock on September 2, 2005. The FMV of the stock on the date of death was $50 per share. On Septembe..

|