Reference no: EM131131924

a. Assuming that the two plans have the same risk as the firm, use the following capital budgeting techniques and the firm's cost of capital to evaluate their acceptability and relative ranking.

(1) Net present value (NPV).

(2) Internal rate of return (IRR).

b. Recognizing the differences in plan risk, use the NPV method, the risk-adjusted discount rates (RADRs), and the data given earlier to evaluate the acceptability and relative ranking of the two plans.

c. Compare and contrast your finding in parts a and b. Which plan would you recommend? Did explicit recognition of the risk differences of the plans affect this recommendation?

d. Use the real-options data given above for each plan to find the strategic NPV, NPVstrategic, for each plan.

e. Compare and contrast your findings in part d with those in part b. Did explicit recognition of the real options in each plan affect your recommendation?

f. Would your recommendations in parts a, b, and d change if the firm were operating under capital rationing? Explain.

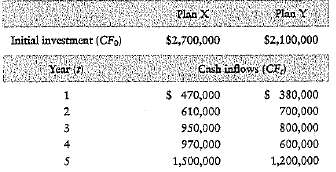

Cherone Equipment, a manufacturer of electronic fitness equipment, wishes to evaluate two alternative plans for increasing its production capacity to meet the rapidly growing demand for its key product-the Cardiocycle. After months of investigation and analysis, the firm has pruned the list of alternatives down to the following two plans, either of which would allow it to meet its forecast product demand.

Plan X

Use current proven technology to expand the existing plant and semi-automated production line. This plan is viewed as only slightly more risky than the firm's current average level of risk.

Plan Y

Install new, just-developed automatic production equipment in the existing plant to replace the current semi-automated production line. Because this plan eliminates the need to expand the plant, it is less expensive than Plan X, but it is believed to be far more risky because of the unproven nature of the technology.

Cherone, which routinely uses NPV to evaluate capital budgeting projects, has a cost of capital of 12%. Currently the risk-free rate of interest, RF, is 9%. The firm has decided to evaluate the two plans over a 5-year time period, at the end of which each plan would be liquidated. The relevant cash flows associated with each plan arc summarized in the following table.

The firm has determined the risk-adjusted discount rate (RADR) applicable to each plan as shown in the following table.

Plan Risk adjusted Discount rate (RADR)

X.......... 13%

Y ........... 15%

Further analysis of the two plans has disclosed that each has a real option embedded within its cash flows.

Plan X Real Option-At the end of 3 years the firm could abandon this plan and install the automatic equipment, which by then would have a proven track record. This abandonment option is expected to add $100,000 of NPV and has a 25% chance of being exercised.

Plan Y Real Option-Because plan Y does not require current expansion of the plant, it creates an improved opportunity for future plant expansion. This option allows the firm to grow its business into related areas more easily if business and economic conditions continue to improve. This growth option is estimated to be worth $500,000 of NPV and has a 20% chance of beingexercised.

|

The cash paid by the partnership to durham

: Each of the continuing partners agrees to pay $18,000 in cash from personal funds to purchase Durham's ownership equity. Each receives 50% of Durham's equity.

|

|

Journalize the admission of atchley under each

: Kensington's capital balance is $32,000 after admitting Atchley to the partnership by investment. If Kensington's ownership interest is 20% of total partnership capital, what were?

|

|

What are some factors to consider when prioritizing

: What are some factors to consider when prioritizing and budgeting environmental compliance initiatives? It doesn’t matter whether you manufacture specialty chemicals or household cleansers, operate a paint shop, sell turf products, or dispose of comp..

|

|

Assume that snider is unable to pay the capital deficiency

: The partners share income and loss 5 : 3 : 2. During the process of liquidation, the following transactions were completed in the following sequence.

|

|

Assuming that the two plans have the same risk as the firm

: Assuming that the two plans have the same risk as the firm, use the following capital budgeting techniques and the firm's cost of capital to evaluate their acceptability and relative ranking. (1) Net present value (NPV).

|

|

The capital balance represents each partner

: Net income is $19,000. Each partner is allowed interest of 10% on beginning capital balances. Caplin is given a $12,000 salary allowance. The remainder is shared equally.

|

|

The post-closing trial balances of two proprietorships

: Prepare separate journal entries to record the transfer of each proprietorship's assets and liabilities to the partnership.

|

|

What is its goal in selecting projects

: Once the firm has determined its projects’ relevant cash flows, what must it do next? What is its goal in selecting projects?

|

|

What is the highest cost of capital that the firm could have

: Develop the relevant cash flows needed to analyze the proposed replacement. Determine the net present value (N.PV) of the proposal. Determine the internal rate of return (ERR) of the proposal. Make a recommendation to accept or reject the replacement..

|