Reference no: EM13299821

Part 1: Case study

Periwinkle Pty Ltd (Periwinkle) is a bathtub manufacturer which sells bathtubs directly to the public. On 1 May 2013, Periwinkle provided one of its employees, Emma, with a car as Emma does a lot of travelling for work purposes. However, Emma's usage of the car is not restricted to work only. Periwinkle purchased the car on that date for $33,000 (including GST).

For the period 1 May 2013 to 31 March 2014, Emma travelled 10,000 kilometres in the car and incurred expenses of $550 (including GST) on minor repairs that have been reimbursed by Periwinkle. The car was not used for 10 days when Emma was interstate and the car was parked at the airport and for another five days when the car was scheduled for annual repairs.

On 1 September 2013, Periwinkle provided Emma with a loan of $500,000 at an interest rate of 4.45%. Emma used $450,000 of the loan to purchase a holiday home and lent the remaining $50,000 to her husband (interest free) to purchase shares in Telstra. Interest on a loan to purchase private assets is not deductible while interest on a loan to purchase income-producing assets is deductible.

During the year, Emma purchased a bathtub manufactured by Periwinkle for $1300. The bathtub only cost Periwinkle $700 to manufacture and is sold to the general public for $2,600.

(a) Advise Periwinkle of its FBT consequences arising out of the above information, including calculation of any FBT liability, for the year ending 31 March 2014. You may assume that Periwinkle would be entitled to input tax credits in relation to any GST-inclusive acquisitions.

(b) How would your answer to (a) differ if Emma used the $50,000 to purchase the shares herself, instead of lending it to her husband?

Part 2: Question

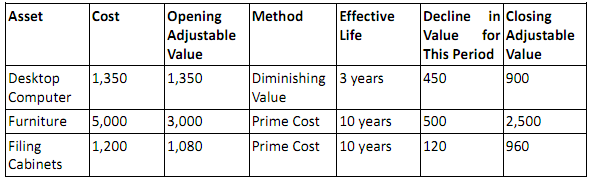

An extract of the asset register of Alpha Pty Ltd (‘Alpha') for the 2012-13 income year is as follows:

All depreciable assets are for 100% business use and Alpha uses a low-value pool for all eligible assets. The closing value of the low-value pool at 30 June 2013 was $5,300. Alpha purchased a printer on 5 June 2014 for $700.

Advise Alpha of the income tax consequences arising out of the above information for the 2013-14 income year.

|

Compute moment of the force about a line through origin

: The force F = 90i + 60j + 20k acts at the point (0,0,40). Compute the moment of the force about a line through the origin that has direction cosines (1/sqrt(3), 1/sqrt(3), 1/sqrt(3), 1/sqrt(3)).

|

|

Determine delta e(rxn) for the combustion of biphenyl

: Find Delta E(rxn) for the combustion of biphenyl in kJ/mol biphenyl. The heat capacity of the bomb calorimeter, determined in a separate experiment, is 5.86 kJ/degrees Celsius.

|

|

Determine the current in the other wire

: Two parallel wires separated by 4.3 cm repel each other with a force per unit length of 1.6 multiply.gif 10-4 Nm. Find the current in the other wire

|

|

Justify selecting this scale of operation

: a.) What is the break-even level of output for each scale of operation? b.) What will be the firm's profits for each scale of operation if sales reach 5,000 units?

|

|

Advise periwinkle of its fbt consequences

: How would your answer to (a) differ if Emma used the $50,000 to purchase the shares herself, instead of lending it to her husband and advise Alpha of the income tax consequences arising out of the above information for the 2013-14 income year.

|

|

Calculate the engineering stress for the bar

: Calculate the following for the bar:a) engineering stress at 0.001 (0.1%) strain, b) elongation, c) Young's modulus, d) final diameter of the bar Note: Poisson's ratio is 0.31 for 4140 steel, e) true stress, f) true strain.

|

|

Explain the concentration of the first ion that precipitates

: A solution contains .10 M iodide ion, I- and 0.10 M carbonate ion, CO32-.... a. If solid Pb(NO3)2 is slowly added to the solution which salt will precipitate first, PbI2 or PbCO3? What will the concentration of the first ion that precipitates when..

|

|

Calculate the maximum design load on a hollow aisi

: Calculate the (maximum) design load on a hollow AISI 1020 steel shaft with an outside diameter of 2.5 inches and an inside diameter of 2 inches. Assume a safety factor of 2.

|

|

Calculate the mass emissions rate of ash into the atmosphere

: The coal has an ash content of 12% by mass. Forty percent of the ash falls out the bottom of the furnace. The rest of the ash is carried out of the furnace with the hot gases into an electrostatic precipitator (ESP).

|