Reference no: EM131248230

Adverse selection and ratings:-

A borrower has assets A and must find financing for a fixed investment I>A. As usual, the project yields R (success) or 0 (failure). The borrower is protected by limited liability. The probability of success is pH or pL, depending on whether the borrower works or shirks, with ?p ≡ pH - pL > 0. There is no private benefit when working. The private benefit enjoyed by the borrower when shirking is either b (with probability α) or B (with probability 1 - α). At the date of contracting, the borrower knows her private benefit, but the market (which is risk neutral and charges a 0 average rate of interest) does not know it. Assume that pLR + B

(i) Interpret conditions (1) and (2) and show that there is no lending in equilibrium.

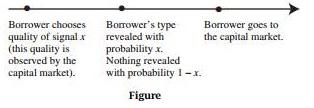

(ii) Suppose now that the borrower can at cost r (x) = r x (which is paid from the cash endowment A) purchase a signal with quality x ∈ [0, 1]. (This quality can be interpreted as the reputation or the number of rating agencies that the borrower contracts with.) With probability x, the signal reveals the borrower's type (b or B) perfectly; with probability 1 - x, the signal reveals nothing. The financial market observes both the quality x of the signal chosen by the borrower and the outcome of the signal (full or no information). The borrower then offers a contract that gives the borrower Rb and the lenders R - Rb in the case of success (so, a contract is the choice of an Rb ∈ [0, R]). The timing is summarized in Figure 6.5.

Look for a pure strategy, separating equilibrium, that is, an equilibrium in which the two types pick different signal qualities.79

- Argue that the bad borrower (borrower B) does not purchase a signal in a separating equilibrium.

- Argue that the good borrower (borrower b) borrows under the same conditions regardless of the signal's realization, in a separating equilibrium.

- Show that the good borrower chooses signal quality x ∈ (0, 1) given by

- Show that this separating equilibrium exists only if r is "not too large."

|

Would you buy greek government bonds (ggbs) now

: How did Greek got into this difficult situation? Whose fault was this - Would you buy Greek Government Bonds (GGBs) now?

|

|

Variable costs of operating the new machine

: In making a decision to replace a machine, which of the following is not relevant? the training that workers will need in order to use the new machine the variable costs of operating the new machine the variable costs of operating the old machine the..

|

|

Prudent level of debt will protect companies

: Research "prudent level of debt" for one of the following companies: Hershey Foods, Verizon, AT &T or EG&G. Discuss how a prudent level of debt will protect companies from financial distress and ensure access to money and capital markets under mos..

|

|

Draw some key diagrams to clarify the important steps

: Write a book report (in MS Word format), indicating the key steps in Feynman's original derivation of Kepler's First Law from the Law of Universal Gravitation, using only high-school algebra and trigonometry. Draw some key diagrams to clarify the ..

|

|

Adverse selection and ratings

: Argue that the bad borrower (borrower B) does not purchase a signal in a separating equilibrium. - Show that this separating equilibrium exists only if r is "not too large."

|

|

Explain one domestic policy that your party would believe in

: Identify and describe one domestic policy that your party would believe in. Give a paragraph description of that domestic policy. Be very detailed and specific in your description.

|

|

Step of the purchase decision

: Consumer behavior Think of a product that you recently bought. Mention, What, Where, How And When you BOUGHT it Describe what happened at every step of the purchase decision

|

|

Present and future values and expected returns

: We examined two important topics in finance this week: (a) present and future values and (b) security valuation.

|

|

How executives develop a reputation for ethical leadership

: Write an annotated bibliography of article - How EXECUTIVES DEVELOP A REPUTATION FOR ETHICAL LEADERSHIP

|