Reference no: EM13317624

Advanced Finance and Risk Management

1. Target forwards were discussed. To recall, a target forward is a variant on the plain vanilla forward contract structure and represents a very aggressive bet on direction. For specificity, consider a short target forward position. If the delivery price in the contract is K and the price of the underlying at maturity is ST, the payoff to a typical short target forward is

K - ST, if K > ST

2 (K - ST), if K <ST

In these payoffs, the loss from a price increase (K < ST) increases twice as fast as the gain from a price decrease (K >ST), implying that the holder of this position is betting aggressively against a price increase.

In contrast, a vanilla forward contract has a linear payoff. The payoff to a short vanilla forward is just

K - ST

or, writing it more elaborately, the payoff is

K - ST, if K > ST

K - ST, if K <ST

Show that the target forward is just a combination of a short position in a vanilla forward and a short position in a plain vanilla option. (Hint: Take the difference in payoffs between the payoff of a target forward and a vanilla forward and see what this looks like.)

2. Apple stock (ticker: AAPL) is currently at $540/share, while Google stock (ticker: GOOG) is currently at $1,150/share. Consider the following options:

• _Option A: A one-month call option to buy Apple stock at a strike of $540. Cost: CA

• _Option G: A one-month call option to buy Google stock at a strike of $1,150. Cost: CG

• _Option AG: A one-month call option to buy a package of one share each of Apple and Google at a strike of $1,690. Cost: CAG

[Note: Under option AG, you either buy the whole package or nothing.]

Which of the following alternatives is most correct? Provide a brief explanation of your answer.

1. CAG > CA + CG

2. CAG < CA + CG

3. CAG = CA + CG

4. Any of the above is possible.

3. A bank issues principal-protected equity-linked notes. The notes come with a face value of $100 and promise holders a semi-annual coupon equal to:

75% of the return on the S&P 500 index, if the index had a positive return

0, if the index had a negative return

For example, if the index goes up by 10% in the preceding 6-month period, investors in the notes will receive a 7.5% coupon, but if the index has zero or negative returns in that period, investors will receive nothing. Thus, investors in the notes are able to participate in the upside of the index but are protected against downside moves.

i. First, assume the bank does not hedge its risk, i.e., it takes no offsetting position in the S&P 500 index or in options on the index.

a. Is there directional risk that the bank faces? That is, does the bank gain or lose when the index goes up? When it goes down?

b. Is there volatility risk that the bank faces? That is, does the bank gain or lose when volatility goes up? When it goes down?

ii. In the language of derivatives, what kind of option on the index has the bank implicitly sold its customers? Put differently, what kind of option (call or put option on the index) should the bank use to hedge its risk?

4.Arne Svensson is regional manager for Southern Europe with Electrolux, based in Stockholm, manufacturers of a range of home appliances sold around the world. Arne has been concerned with the Eurozone sovereign debt difficulties since at least 2009, given that some of the most affected countries fall into his area of responsibility (Greece, Portugal, Spain, Turkey and Italy). He keeps a careful eye on media reports. Together with his team he has been working on a sensitivity analysis of possible future scenarios in Southern Europe (including Turkey), segmented by target market and by product line.

A staff report notes that the approximate cost content of Electrolux vacuum cleaners is 20% China, 40% Mexico, 10% Finland and 30% Malaysia (final assembly). Today the discussion focuses on marketing priorities for Portugal and Ireland in comparison to the other countries in Arne's sales territory. One of his assistants has come across the S&P and BlackRock ratings.

To what extent is this information helpful in helping Arne think through the possible condition of these two markets a year from now (January 2015) in terms of identifying a number of alternative scenarios? What are the strengths and weaknesses of each approach? Identify Arne's risk exposure and recommend a sensible risk management strategy that he might consider. Word limit: 1,800.

5. Read the article on compliance officers (Annex 1) and review the slides (Annex 2) on JP Morgan's compliance problems in the context of the various risk-framework domains that affect any business firm - driven by its strategic positioning and execution.

Compliance costs to JPM shareholders exceed $20 billion over the last three years - Morgan has provisioned a total of $26 billion. A cost of doing business? A loss of control? A coincidence of random events? What should happen next, in your opinion.

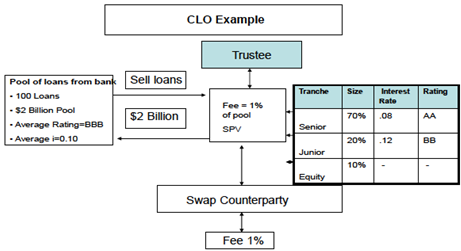

6.Collateralized Loan Obligation (CLO) Question

What is the expected Return on Equity for the equity tranche in each of the first two years of a five year CLO (Collateralized Loan Obligation)?

Information:

•$2.0 billion dollar pool.

•Fees are paid at the end of the year and are 1% (of face value) in the first year and 1% (of face value) in the second year.

•Assume that the defaults occur at the beginning of the second-half of each year.

•The recovery from the defaults is invested immediately at (5%).

•The annual interest on the pool of loans (i=10%) is paid semiannually and is based on the remaining balance of loans in the pool.

•The default rates and recovery rates are provided below: Losses are not reduced from equity until the end of the CLO.

Year One Year Two

Default Rate 3% 8%

Recovery Rate 40% 40%