Reference no: EM13381040

1. Mesquite Corporation has a bond outstanding with a $80 annual interest payment, a market price of $850, and a maturity date in ten years. Please find

a. The coupon rate

b. The current rate

c. The approximate yield to maturity

2. An investor must choose between two $1,000 par value bonds:

Bond A pays $80 annual interest and has a market value of $800. It has 12 years to maturity.

Bond B pays $85 annual interest and has a market value of $880. It has 4 years to maturity.

a. Compute the current yield on both bonds.

b. Which bond should he select based on your answer to part a?

c. Compute the approximate yield to maturity on both bonds.

d. Has your answer changed in terms of which bond to select?

3. A 5-year, $1,000 par value, zero-coupon rate bond is to be issued to yield 10%.

a. What should be the initial price of the bond

b. If immediately upon issue, interest rates dropped to 8%, what would be the value of the zero-coupon rate bond?

c. If immediately upon issue, interest rates increased to 12%, what would be the value of the zero-coupon rate bond?

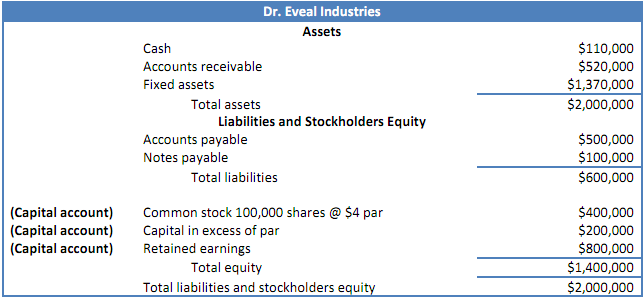

4. Dr. Eveal Industries has the following balance sheet (The firm has a market price of $22 a share):

a. Show the effect on the capital account(s) of a two-for-one stock split.

b. Show the effect on the capital account of a 10 percent stock dividend. (Part b is separate from part a)

c. Based on the balance in retained earnings, which of the two dividend plans is more restrictive on future cash dividends?

5. Dinocom Inc. earned $250 million last year and paid out 25% of earnings in dividends.

a. By how much did the company's retained earnings increase?

b. With 50 million shares outstanding and a stock price of $60, what was the dividend yield?

6. The shares of Bankston Company sell for $75. The firm has a P/E ratio of 12. Fifty percent of earnings are paid out in dividends. What is the firm's dividend yield?

7. Suppose a Swedish krona is selling for $0.1121 and a Maltan lira is selling for $2.7878. What is the exchange rate of the Swedish krona to the Maltan lira?

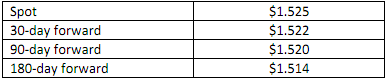

8. About three years ago, the following spot and forward rates for the British pound ($/£) were reported:

a. Was the British pound selling at a discount or premium in the forward market?

b. What was the 30-day forward premium (or discount)?

c. What was the 90-day forward premium (or discount)?

d. Suppose you executed a 90-day forward contract to exchange 100,000 British pound into U.S. dollars. How many dollars would you get 90 days hence?