Positive and normative economics -introductiion

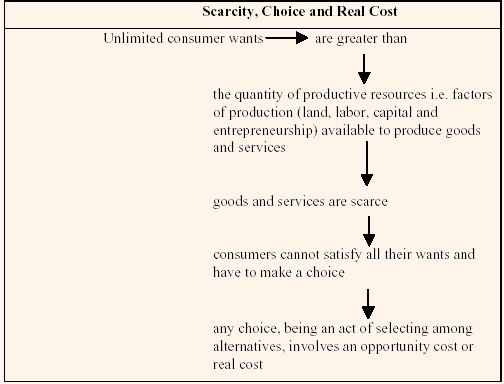

Economic theory or analysis evolves from basic propositions about how individual human beings (or individual economic units) behave, struggle with the problem of scarcity, and react to an observed change. The reality is that resources available to produce goods and services are limited and thus goods and services are also limited. However, the wants of human beings are virtually unlimited. For instance, a consumer (i.e. anybody who buys or purchases) may want food, then more food and better food. Consumers may decide to satisfy some of their wants but this will mean that other wants may go unsatisfied. These facts confront us with the two basic ingredients of economic phenomena, namely, scarcity and choice. And this choice will involve an opportunity cost, which is the best alternative choice which has been foregone. For instance, a consumer may have to decide whether to go on a holiday trip or purchase a new vehicle. If he decides to purchase the new vehicle, then the opportunity cost is the holiday trip foregone.

Opportunity cost is often referred to as the real cost of making a choice. It does not apply only to individual consumer choices at a micro-level but also to community choices at a macro-level. For example, policy makers may decide to develop more communication networks and fewer healthcare facilities. The opportunity cost of the new communication networks is the lack of adequate healthcare facilities. Since productive resources, income and time availability are scarce or limited, we must make a choice - an act of selecting among limited alternatives. In fact, a major focus of economics concerns how individual economic units choose when the alternatives open to them are limited. The diagram given below explains the basic economic problem which underlies all economic problems. And it is this problem which all economic systems are struggling to overcome.

As stated earlier, economic analysis is developed from basic postulates of human behavior. It furnishes us with a set of tools which we can use for understanding the nature of observed economic activity. The theory has a reputation for being abstract and difficult to understand, but this is not true. Economic analysis always establishes reference points indicating what to look for and how economic issues are interrelated. It helps us in understanding the relationships among complex and often unrelated economic events in the actual world. Though the analytical tools are inadequate, they enable us to analyze certain common features of individual economic occurrences. Like other sciences, economic analysis also provides us with the general propositions which can be employed in understanding economic phenomena. However, the limitations are greater in the case of economic analysis because the problems of measurement and forecasting are more difficult than in natural sciences. The limitations may emanate from the assumptions which form the basis of these propositions. The assumptions of economic theory on which the economic generalizations are based should reflect the reality, if theory is to serve the purpose of understanding economic issues and providing solutions.

Why money is not scarce

There was an opinion that one way in which the problem of scarcity could be solved is by the government pumping more money into the economy. In fact it would be very easy for governments to print more money and give some to every individual. However this would be a futile exercise since the problem is one of scarcity of goods and services and not of scarcity of money.

Under conditions of hyperinflation prices rise ten or even a hundred fold in a single month. When there was hyperinflation in Germany during the early 1920s and in China around the period of the Second World War, the printing presses broke records daily in the value of notes they produced. In Germany, the process continued, until the amount of currency produced reached 400 quadrillion marks each day. Records were similarly broken daily in China and Hungary.

Did such increases in the money supply solve the problem of scarcity? The answer is 'no'. Most of the people in both Germany and Hungary became poorer during the period of hyperinflation and many factories and shops were closed down as a result of it. Far from solving the problem of scarcity, printing more money was a principal cause of declining living standards and abject poverty for many people in these countries.

The question is why does this happen. Simply because money is a claim to output. Where we have money, we can use it to buy, or claim goods and services. If every one has more money there are more claims and demand for the same or available quantity of goods and services. Printing more and more money can only lead to ever increasing money supply in relation to the available goods and services and unprecedented rise in inflation. If it were possible to solve the economic problem by printing more money into the economy, there would be no need for economists, because the main problem underlying all economic problems would cease to exist.