Reference no: EM131208431

IPE MBA Assignment Question for Managerial Accounting

Question:

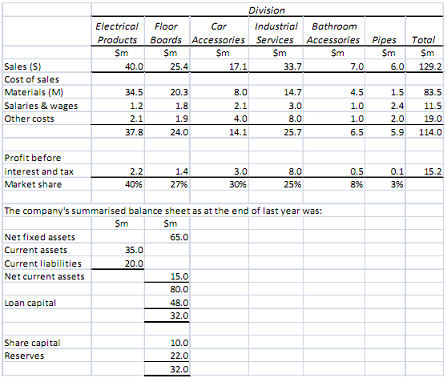

Triton Corporation is a manufacturing company located in a country that has experienced rapid economic growth from the late 1990s to the early 2000s and then went into an economic recession in the following decade. It has now emerged from the recession to earn a profit before interest and tax of $15.2 million last year (2014). The company has six operating divisions, and the results for last year were as follows.

The assignment requires knowledge and the application of capital investment decisions (capital budgeting), gearing, financial ratios and budgetary controls.

Required -

You are asked to prepare a report to address the following matters/concerns that have been raised by the Managing Director of the company.

(a) As a going concern, he wishes to evaluate the six divisions in light of growing competition as the economy continues to grow. He has asked you to identify and assess:

- the product divisions that are producing low value-added items and require huge working capital investments, and

- the implications of low value-added items for financial returns and profitability.

(b) He wishes to make a strategic decision about the long-term viability of both the bathroom accessories division and the pipes division due to the very competitive environment both divisions are competing in. As both divisions would require considerable capital expenditure to improve efficiency and to make them more competitive, he has decided to sell them.

Critically evaluate the arguments for selling the two divisions, even though both are profitable.

(c) The company needs to reduce its financial gearing, which is too high. However, the company also needs to spend large sums of capital for equipment replacement and modernisation programmes, investments in new projects and new product developments. All capital investment projects should have a target payback period.

(i) Identify and analyse the factors which should influence how long the payback period should be for equipment replacement programmes and new development projects.

(ii) Critically analyse the relative importance of the strategic aim of reducing gearing and the aim to continue to invest in modernisation programmes.

(d) The company is about to introduce a decentralisation programme in which decision making is pushed down the line and head office staff is cut from 48 in number to just 20. The Managing Director believes that control can be exercised from head office by having a regular reporting system using financial ratios and budgets.

(i) Advise the managing director on the reliance of using financial ratios analysis and budgetary controls for co-ordination and control of the group and the possible risks that Triton may face.

(ii) Critically analyse how you would expect the management accounting function and ethical issues to be re-organised if the company expands its operations to a number of different low-cost countries.

Instructions for the REPORT:

As the assignment requires several tasks to be completed, the required report format of 4,000 words (maximum) should be organised as follows:

1. Executive Summary (200-300 words, not to be included in the word count)

2. Table of contents (not to be included in the word count)

3. Introduction

4. Main body

The main body should address the requirements as stated in parts (a), (b), (c) and (d) of the question.

5. Conclusion

6. References.

|

What is the power factor of the generator

: With the switch closed, find the real power P, reactive power Q, and apparent power S supplied by the generator. What is the power factor of the generator?

|

|

Measure for performance evaluation of an investment

: Residual income is a better measure for performance evaluation of an investment center manager than return on investment because: (CMA adapted)

|

|

Prepare the journal entry to record income tax expense

: Bandung Corporation began 2014 with a $95,400 balance in the Deferred Tax Liability account. At the end of 2014, the related cumulative temporary difference amounts to $359,700, and it will reverse evenly over the next 2 years. prepare the journal en..

|

|

How you incorporate anita parents and school into your plan

: Include issues of gender, diversity, and ethics in your plan. As the counselor meeting with Anita, how will you manage state-mandated reporting laws and maintaining Anita's confidentiality within the community?

|

|

Critically evaluate arguments for selling two divisions

: He wishes to make a strategic decision about the long-term viability of both the bathroom accessories division and the pipes division due to the very competitive environment both divisions are competing in. Critically evaluate the arguments for sel..

|

|

What combination of poles on the two machines could convert

: If the two machines have different numbers of poles but exactly the same shaft speed, then the electrical frequency of the two machines will be different due to Equation (3-34). What combination of poles on the two machines could convert 60 Hz pow..

|

|

Explain summary of green initiatives for a city in your area

: Explain a summary of green initiatives for a city in your area. Recommendations to your local government for creating a greener, more sustainable and livable community.

|

|

Does the literature present a balanced view

: The abstract should provide a very concise overview or summary of the research - what was done and why, the methods used, and the key results and recommendations - Does the literature present a balanced view?

|

|

Write about the american culture and the holidays

: write 5 sentences about the my culture (american), and the holidays you celebrate. - This can be in english or spanish.

|