THE ROLE OF THE MODERN FINANCIAL MANAGER

In huge firms, the finance occupation is frequently related with a top representative of the corporation, normally a chief financial officer and vice president, and some smaller officers and employees. The treasurer and the regulator each statement to the chief financial administrator and both has well-definite areas of accountability within the rigid. The treasurer is accountable for handling temporary (daily) cash flows, making resources- spending decisions, and recommend financial plans to elevate funds from outside sources. Typically, these decisions are expected over a three- to five-year time horizon. The organizer handles the accounting everyday jobs, which comprise tax management and preparation, cost and financial statement accounting, and in sequence systems.

As we've previously affirmed, the most significant job of a financial manager is to generate value from the firm's capital budgeting, financing, and working capital management decisions. Financial managers generate value in two general ways:

1. The rigid need to be possessions that produce more cash for the rigid than they cost.

2. The rigid sells stocks and bonds and other financial instruments that elevate more cash than they cost in stipulations of predictable future payments.

Thus, in both cases, the firm creates more cash flow than it uses to amplify value. The cash flow paid to bondholders and shareholders of the firm should be elevated than the cash flows

put into the rigid by the bondholders and shareholders. To see how this works, we can suggestion the currency flows from the rigid to the financial markets and back again.

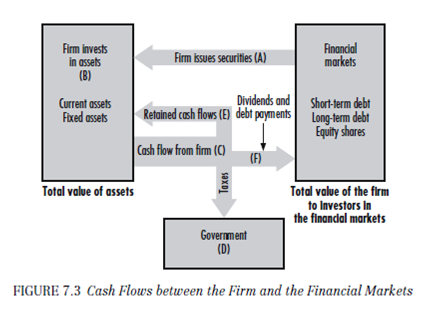

The interaction of the firm's financial decisions with the financial markets is shown in Figure. The arrows in Figure sketch cash flow from investors in the financial markets to the rigid and back again. Consider first the firm's financing actions. To raise money the firm sells debt and common stock to investors in the financial markets. This consequence in cash flows from the financial markets to the rigid (A). This cash is invested in the investment behavior of the rigid (B) by the firm's management. The cash generated by the rigid (C) is paid to shareholders and bondholders (F). The shareholders obtain cash in the form of dividends or share repurchases; the bondholders who loaned finances to the firm receive attention expenditure and, when the initial loan is repay, principal. Not all of the firm's cash is paid out. Some is retained to repay the firm's future financial obligation or reinvested in new possessions (E), and some is paid to the government as taxes (D).

Over time, if the cash paid to shareholders and bondholders (F) is greater than the cash raise in the financial markets (A), assessment will be fashioned.

While this procedure may seem relatively straightforward, the most excellent financial managers must aggressively organize a huge range of behavior within the firm to make certain uniformity of goals and targets. Here are some detailed activities that the financial manager participates in to exploit the value of the firm:

1. Forecasting and planning. The financial staff interacts with officers and employees from other departments such as engineering, marketing, and construction to project the firm's potential plans and to assess the impact of that strategy on the firm's financial strength.

2. Major investment and financing decisions. A victorious firm frequently has rapid development in sales, which require reserves in plant, equipment, and functioning capital. The financial manager determines the most competent sales growth rate and helps to make a decision on the precise assets to obtain as well as the best way to finance those possessions. For example, should the firm finance with balance or evenhandedness, and if debt is used, should it be long term or short term? Ultimately, a financial manager must communicate that there's a big difference between commercial and unprofitable growth, no substance how fast sales are growing.

3. Coordination and control. The financial staff also inters acts with other officers and employees to make certain that the rigid operating and financing strategy are implemented as professionally as probable. All business decisions have financial implications, and all managers-financial and or else- need to understand this principle. For example, marketing decisions influence sales growth, which in turn affects speculation and working capital necessities. Thus marketing decision makers must be able to understand how their actions affect (and are affected by) factors such as the avail- ability of funds, receivables policies, inventory policies, and plant capacity operation.

4. Dealing with the financial markets. The financial organization interacts with the money and capital markets to converse the rationale following its speculation decision. Every rigid affects and is exaggerated by the general financial markets-it is where finances are raised, where the firm's securities are traded, and where its investors are either satisfied or penalized. Because a firm's supply price is an revealing needle of how well the rigid operating and financing strategy are working as well as how investors view those strategy, it is closely monitored by both investors and managers. This express link in between management decisions and stock prices also provides the rigid with immediate feedback on the organization overall plan.

In review, financial managers make decisions concerning which property their firms should spend in, how those property should be financed, and how the rigid should administer its accessible possessions and future opportunity. If these tasks are perform well, financial manager's help maximize the assessment of their rigid, and also maximize the long-run welfare of other commercial stakeholders such as clientele who buy foodstuffs from the corporation, suppliers who provide creative inputs for the firm, and employees who work for the corporation.