Capital Structure

Sometimes it is functional to think of the rigid as a pie. The size of the pie will depend on how well the rigid has made its speculation decisions. After a firm has made its investment decisions, the value of its possessions (e.g., its land, buildings, and inventories) is resolute.

Financing preparations determine how a firm's value is separated among the different entities that have given funding for the organization. The persons or institutions that buy debt from the firm are called creditors. The holders of equity shares are called shareholders. In stipulations of our "firm-as-a- pie" equivalence, financing preparations determine how the pie is sliced. Creditors and shareholders are permitted to slices, and the size of those slices depends on how well the firm makes its speculation decisions as well as how much money each originally contribute to the firm.

The firm then determines its capital construction. The firm might originally have raised the money to spend in its resources by issue more debt than impartiality. Afterward it might believe changing that mix by issuing more evenhandedness and using the earnings to devote in new projects or to buy back some of its debt. Financing decisions like the concluding can often be made separately of the inventive speculation decisions. The decisions to issue debt and evenhandedness should be thought of as first and foremost touching how the pie is sliced. They can, however, also affect the size of the pie itself. Thus, an imaginative financial manager can affect value through both investing and financing behavior.

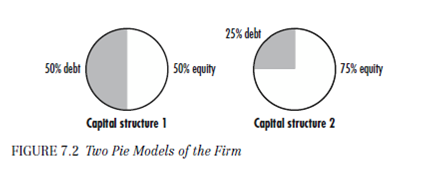

Figure provides a graphic illustration of this discussion. The size of the pie is the worth of the firm in the financial markets, and it reflects investors' accepting of the investing and financing behavior of the firm. We can describe the value of the firm, V as consisting of two parts,

V = B + S

where B is the value of the debt and S is the value of the impartiality. The pie diagram defines two ways of slicing the pie 50 percent debt and 50 percent impartiality, and 25 percent debt and 75 percent impartiality. The way the pie is sliced could influence its value. If so, the goal of the financial manager will be to choose the finest financing understanding that makes the value of the pie-that is, the price of the firm, V-as large as potential.