We have earlier explained working capital by total current assets less current liabilities. It, in other words, implies that all the assets held through the business along with the objective of conversion in cash as including cash during an operating cycle of the business. Of these assets, a part is financed through short-term credits that are to be met during the operating cycle representing current liabilities. Hence current assets less current liabilities or else working capital demonstrates amount of resources spent in current assets from sources of finance but the current liabilities also. Such net amount is also the amount obtainable for use in the business in the appearance of fund. Consider the subsequent illustration.

Ramsons are a retail outlet dealing in domestic appliances and entertainment electronics equipment, owned through Ram. The investment into the showroom, display counters,' furniture, cash register, fixtures and so on is Rs. 6, 00,000. Ram decides to utilize straight line depreciation at the rate of 10 percent per-annum.

Ramson's evaluated sales is Rs. 1,50,000 per month: 50,000 cash sales and Rs. 1,00,000 on credit to be collected in four equivalent monthly installments. All sales are made at 25 percent margin on selling price.

Sales and supply constraints would warrant carrying three months sales needs in the form of inventory. Likewise, month's cash expense requirements have to be conduct in cash balance.

Initial inventory is to be bought for cash and replenishment purchases will obtain a month's credit from suppliers.

Average monthly cash need for meeting operating expenses but payment for purchases amount to Rs. 26,000. Ram requires withdrawing Rs. 4,000 per month for his personal requirements.

1. How much working capital will Ramsons need to start operations?

2. Will he need additional working capital throughout the first four months? Otherwise will he have surplus working capital throughout the first four months?

You can instinctively answer such questions through saying that Ramsons requires working capital to pay for inventory or for expenses and for keeping safe cash balance. You can put also a statement that Ramsons will obtain funds from operations to meet several of these needs. To be more exact, how much money does he need? This could be done through working out a schedule of cash payments and cash receipts on a monthly basis. This is also possible for us to prepare proforma monthly balance sheet and profit and loss account. You can also see that we have chosen the first four months consciously as it completes one operating cycle of the business.

RAMSONS: Schedule of Cash Payments

|

Month

January

|

Explanation

Operating Expenses

|

Amount Rs.

26,000

|

Total Rs.

|

|

|

|

Withdrawals

|

4,000

|

30,000

|

|

|

February

|

January Purchases

|

1,12,500

|

|

|

|

|

Operating expenses

|

26,000

|

|

|

|

|

Withdrawals

|

4,000

|

1,42,500

|

|

|

March

|

February Purchase

|

1,12,500

|

|

|

|

|

Operating expenses

|

26,000

|

|

|

|

|

Withdrawals

|

4,000

|

1,42,500

|

|

|

April

|

March purchases

|

1,12,500

|

|

|

|

|

Operating expenses

|

26,000

|

|

|

|

|

Withdrawals

|

4,000

|

1,42,500

|

|

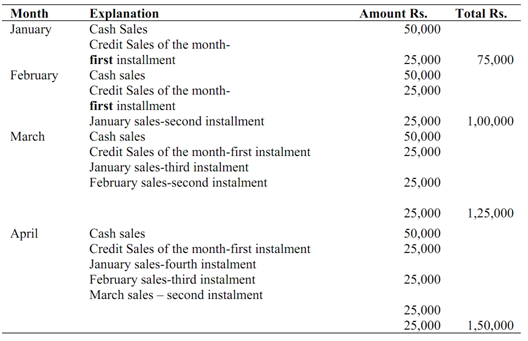

RAMSONS: Schedule of Cash Receipts

Opening balance sheet of Ramsons will be as given below:

RAMSONS: Balance Sheet as of January 1,2003

|

Assets

|

Rs.

|

Liabilities and

|

Rs.

|

|

|

|

|

Capital

|

|

|

Fixed Assets

|

|

6,00,000 Capital

|

|

9,67,500

|

|

Inventory

|

|

3,37,500

|

|

|

|

Cash

|

|

30,000

|

|

|

|

|

|

9,67,500

|

|

9,67,500

|

We have assumed here the whole asset needs are financed by owner's capital. Working capital of Ramsons on the January 1, 2003 year is as given:

|

Current Assets: Inventory

|

3,37,500

|

|

|

Cash

|

30,000

|

|

Total Current Assets

Less: Current Liabilities

|

3,67,500

Nil

|

|

Working Capital

|

3,67,500

|

|

|

|

|

RAMSONS: Schedule of Cash Balances

January February March April

|

Opening Balance

|

30,000

|

75,000

|

32,500

|

15,000

|

|

Cash Receipts

|

75,000

|

1,00,000

|

1,25,000

|

1,50,000

|

|

Total Cash available

|

1,05,000

|

1,75,000

|

1,57,500

|

1,65,000

|

|

Less: Cash Payments

|

30,000

|

1,42,500

|

1,42,500

|

1,42,500

|

|

Cash Balance

|

75,000

|

32,500

|

15,000

|

22,500

|

RAMSONS: Profit and Loss Account for the Month ending

31st January 28th February 31st March 30th April

|

Sales

Less: Cost

|

1,12,500

|

1,50,000

|

|

1,12,500

|

1,50,000

|

|

1,12,500

|

|

1,50,000

|

|

1,12,500

|

1,50,000

|

|

of Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

Expenses

|

26,000

|

|

|

26,000

|

|

|

26,000

|

|

|

|

26,000

|

|

|

Depreciation

|

5,000

|

1,43,500

|

|

5,000

|

1,43,500

|

|

5,000

|

|

1,43,500

|

|

5,000

|

1,43,500

|

Net Profit: 6,500 6,500 6,500 6,500

RAMSONS: Balance Sheet as at the end of

|

|

Assets

|

31st January

2003

|

28th February

2003

|

31st March

2003

|

|

30th April

2003

|

|

Fixed Assets

|

6,00,000

|

6,00,000

|

6,00,000

|

|

6,00,000

|

|

Less: Depreciation

|

5,000

|

10,000

|

15,000

|

|

20,000

|

|

Net Fixed Assets

|

5,95,000

|

5,90,000

|

5,85,000

|

|

5,80,000

|

|

Inventory

|

3,37500

|

3,37,500

|

3,37,500

|

|

3,37,500

|

|

Receivables

|

75,000

|

1,25,000

|

1,50,00

|

|

1,50,000

|

|

Cash

|

75,000

|

32,500

|

15,000

|

|

22,500

|

|

Total Current

Assets

|

4,87,500

|

4,95,000

|

5,02,500

|

|

5,10,000

|

|

Total Assets

|

10,82,500

|

10,85,000

|

10,87,500

|

|

10,90,000

|

|

Liabilities and

Capital

|

|

|

|

|

|

|

Capital

|

9,67,500

|

9,67,500

|

9,75,000

|

|

9,77,500

|

|

Add: Retained

Earnings

|

2,500

|

5,000

|

1,12,500

|

|

1,12,500

|

|

Owner's Equity

|

9,70,000

|

9,72,500

|

9,75,000

|

|

9,77,500

|

|

Accounts Payable

|

1,12,500

|

1,12,500

|

1,12,500

|

|

1,12,500

|

|

|

|

10,82,500

|

10,85,000

|

10,87,500

|

|

10,90,000

|

|

|

|

|

|

|

|

|

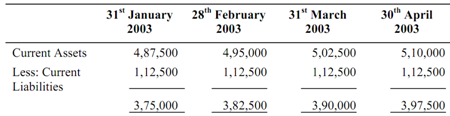

RAMSONS: Schedule of Working Capital

Funds from Operations

|

Net Profit

|

6,500

|

6,500

|

6,500

|

6,500

|

|

Add: Depreciation

|

5,000

|

5,000

|

5,000

|

5,000

|

Total funds generated from operations

11,500 11,500 11,500 11,500