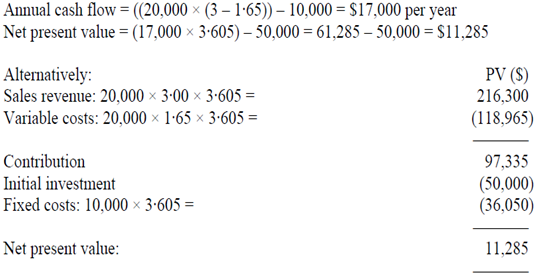

Q. Show Calculation of project net present value?

Sensitivity of NPV to sales volume

Sales volume giving zero NPV = ((50000/3·605) + 10000)/1·35 = 17681 units

This is a reduce of 2319 units or 11·6%

On the other hand sales volume decrease = 100 × 11285/97335= 11·6%

Sensitivity of NPV to sales price

Sales price for zero NPV = (((50000/3·605) + 10000)/20000) + 1·65 = $2·843

This is a decrease of 15·7c or 5·2%

On the other hand sales price decrease = 100 × 11285/216300 = 5·2%

Sensitivity of NPV to variable cost

Variable cost should increase by 15·7c or 9·5% to $1·81 to make the NPV zero.

On the other hand variable cost increase = 100 × 11285/118965 = 9·5%

Sensitivity analysis assesses the effect on project net present value of changes in project variables. The purpose is to determine the key or critical project variables which are those where the smallest change produces the biggest change in project NPV. It is restricted in that only one project variable at a time may be changed whereas in reality several project variables may change simultaneously. For instance an increase in inflation could result in increases in variable costs, sales price and fixed costs.

Sensitivity analysis isn't a way of evaluating project risk since though it may identify the key or critical variables it can't assess the likelihood of a change in these variables. Alternatively sensitivity analysis doesn't assign probabilities to project variables. Where sensitivity analysis is helpful is in drawing the attention of management to project variables that require careful monitoring if a particular investment project is to meet expectations. Sensitivity analysis is able to as well highlight the need to check the assumptions underlying the key or critical variables.