Bond Price is the purchase value of a bond. It can be priced either at a premium, discount or at par. It is important for the prospective buyer to know how to determine the price of a bond; this is because bond price correlates with its yield and this helps the buyer to decide whether to purchase the bond or not.

A bond is said to be priced at a premium when its price is higher than its par value. This can be done only when its interest rate is higher than the prevailing rates. A bond is said to be priced at a discount when its price is lower than its par value. This is possible only when its interest rate is lower than the prevailing rates.

Normally, bond price is fixed by calculating the maximum price an issuer wants to pay for the bond. Comparing the bond's coupon rate with the average rate most investors are currently receiving in the bond market.

Yield is the return an investor receives on maturity of his bond. Usually, every investor wants to know the earning on his proposed bond investments. For this, he needs to know how to calculate the yield on a bond. A required yield, on the other hand, is the yield on a bond, which an issuer must offer to persuade the investor to invest in such bond. Most often, their required yield depends upon the yield offered by other plain vanilla bonds having similar credit quality and maturity. Usually, it is equal to or greater than the prevailing interest rates. Thus, an investor can calculate the yield on his proposed bond investment once he makes a decision on his required yield.

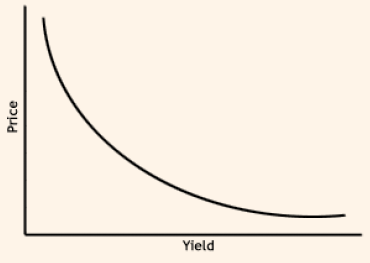

Relationship between Price and Yield: The price and yield relationship is inversely related i.e., when bond price goes up, yield comes down and vice versa. The reason being - bond's price will be higher when it pays a coupon which should necessarily be higher than the prevailing interest rates. As the market interest rates increase, bond's price decreases.

Figure 1

Further, when a bond is issued at a premium, the coupon rate (yield) is greater than market interest rates. Similarly, when a bond is issued at a discount, the coupon rate (yield) is lesser than the market interest rates.

It is accepted that high prices and high yields in terms of bonds are good. But they both cannot happen at the same time. The logic behind this being - an investor normally wants high yield, which should be higher than his bond price.