Pecos Canyon Winery is a small vineyard/winery located in the Big Bend area of West Texas. The initial cabernet grape vines were planted in the spring of 2004 with the first wine produced and ready for bottling in late 2008. Company management considers it advantageous to separate operations into three distinct divisions for accounting and financial purposes: vineyard, winery, and bottling & distribution. The bottling & distribution operation was started in early January 2009 with sales made directly to various retail wine stores in the state of Texas. The high quality of Pecos Canyon's wines created an immediate following. Thus, sales increased rapidly, and the success of the company has exceeded management expectations. At conclusion of the 2009 fiscal year, it was determined that the company should be using formal written budgets to assist in planning and controlling financial operations. The first quarter of 2010 has been used to accumulate the necessary financial data and develop procedures to follow in preparation of quarterly master budgets. Effective for the second quarter of 2010, the bottling & distribution division has been selected for a trial utilization of formal budgeting. The following information is presented for preparation of the various detailed budgets and accompanying schedules:

1. Wine is bottled in 750 milliliter bottles and packed in 12-bottle cases.

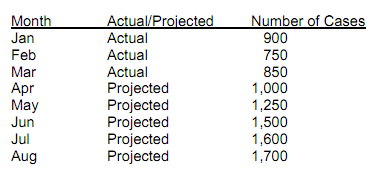

2. Sales for the year 2010 are as follows:

3. The wine sells to retailers at $8.25 per bottle ($99 per case) on account with payment due in 10 days in accordance with State of Texas laws. Seventy Percent of each month's sales are collected in the month of sale, and the remaining Thirty Percent is collected in the following month.

4. The company desires to have in bottled-wine inventory (cases) at the end of each month 20% of the forecasted sales in the following month. (Hint: This is needed for the Production Budget.)

5. Fermented and aged wine is purchased from the company's winery at $7 per liter (the winery's full absorption cost) with payment made in the month of purchase. The end of month inventory of unbottled wine is set at an amount in liters equal to 10% of the following month's production. (Hint: This is needed for the Direct Materials Budget.)

6. Bottles, corks, labels (one for each 750 milliliter bottle of wine) are purchased from outside suppliers at a combined cost of $0.50. Fifty percent (50%) of the cost of each month's purchases are paid in the month of purchase, and the remaining 50% paid in the following month. The end of month inventory of bottles and etc. is set at an amount equal to 10% of the following month's production.

7. Variable direct labor in the bottling & distribution division costs an average of $10.00 per hour, and one quarter (0.25) of an hour is required to bottle and package a 12-unit case of wine. All labor costs are paid in the month that they are incurred.

8. Manufacturing overhead is applied per direct labor hour at a variable cost of $3.00 per hour. Fixed overhead is forecast to be $2,200 per month including depreciation expense.

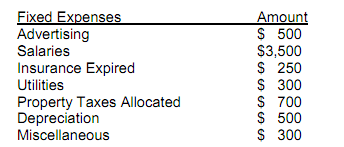

9. Variable selling & administrative expenses (including State liquor tax) are forecast to be $5.00 per case sold each month. Fixed monthly expenses are as follows:

10. The company's bottling & distribution division was formed (incorporated) on January 1, 2009 with a stock subscription of $185,000, which was used to purchase the necessary land, buildings, and equipment to start operations. All depreciable property is depreciated at straight-line rates for an estimated useful life of 10 years with no salvage value. On April 1, 2010, a cash expenditure in the amount of $24,000 will be made for additional bottling and packaging equipment. This new equipment is also depreciated at the 10-year straight-line rate with no salvage value.

11. Each month, a $1,000 cash dividend distribution is made to the corporate stockholders.

12. The company is in the 30% federal income tax bracket. Taxes are accrued at the end of each quarter and paid in the first month of the following quarter.

13. The company desires to maintain a minimum balance of $20,000 in their cash account at each month end. A line of credit is available from a local bank to borrow from as needed. All borrowings, in increments of $1,000, are to be made at the first of the month. Repayments, in increments of $1,000, are to be made at the end of the month. Interest is at 12% per annum (1% per month without compounding) and is to be computed monthly. It is paid on the last day of each quarter for the amount owed during the quarter.

REQUIREMENTS:

This assignment is made as a individual project.

a) Using Microsoft Excel (computerized spreadsheet program), prepare a master budget (all applicable detailed budgets, supporting schedules, and proforma financial statements) for the Bottling & Distribution Division for the second quarter of 2010. A spreadsheet template with beginning balance sheet balances is provided on Blackboard to assist you. You must use formulas to perform the necessary calculations and to link data between spreadsheets. Do NOT try to manually transfer numbers between sections of the worksheet.

b) Also, you will need to submit a copy of your Excel Spreadsheet file via Blackboard.

c) Prepare in written form your recommendations for the company to consider in its budgeting process and business operations for future quarters.