To begin with, we require two successive balance sheets and the operating statement or loss and profit account relating the two balance sheets.

There are two ways wherein this statement can be drawn up. One approach is to begin with the operating cash balance, the profit or loss are add or deduct from operation to this and then proceed to provide effect to the change of each item of current assets and liabilities together along with the additions to and reductions in the other assets and shareholders' funds and long term liabilities and lastly arrive at the closing cash balance. This is termed as the "Profit basis" statement. For the sake of good understanding, the changes in items of shareholders, current liabilities, current assets' fund, long life assets and long-term liabilities can be organized beneath the three broad categories of operating, financing and investing activities that discussed above, changes measured beneath each category, the opening cash balance adjusted to such changes and the closing cash balance appeared at.

The second method is to deal only along with disbursements and cash receipts. It does not consider non-cash items as depreciation, preliminary expenses written off. The latter kind of cash flow statement is termed as "Cash basis" statement.

Preparation of a cash flow statement on cash origin is a straight forward exercise and left to the students. Now, we would take up the cash flow statement on "profit basis" for additional examination. A framework of the steps to be followed for this reason is appended as given:

Steps included in preparation of a "Profit basis" cash flow statement as:

1. BY the first of the two balance sheets, get the closing cash balance that will be the opening cash balance for the reason of our cash flow statement.

2. Get the net profit figure. If this is not directly specified and you are provided along with only Profit and Loss account balances in both the Balance Sheets, ascertain this that is net profit, through preparing an "Adjusted Profit and Loss account". For this reason, all items of profit appropriations and also non-cash expenses and income are to be added to and subtracted from the balance of P and L account, as the case may be. This offers the figure of "Profit from operation."

3. Adjust raise or decrease in each item of current liabilities and current assets to the "Profit from operation" figure to arrive on the "Cash from operation".

4. Reverse to the "Opening Cash Balance". Add the "Cash from operation" to this. Also add cash flow from other sources like non-current assets and non-current liabilities, for example: equity and debenture matter, increasing term loan, sale of fixed assets. Subtract, cash outflow to different uses, again including non-current or fixed assets and non-current liabilities, for illustration: redemption of debentures or preference shares, purchase of fixed assets, retirement of term loan, etc.

5. The balance arrived on (4) above must tally with the closing balance of cash in the second balance sheet.

Raises and decreases in different items of assets and liabilities as mentioned beneath items 3 and 4 above can be optionally organized according to operational, financing and investment activities for clarity sake.

We utilize the above procedure and approach in preparing a "profit-basis" cash flow statement in Illustration 3.

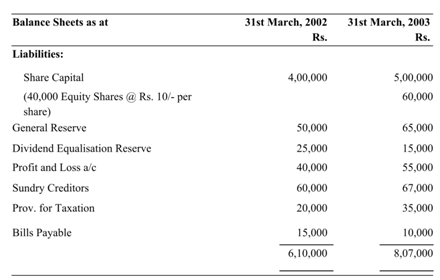

Illustration 3

M/s Navyug Udyog

|

Balance Sheets as at

|

31st March, 2002

Rs.

|

31st March, 2003

Rs.

|

|

Assets:

|

|

|

|

Freehold Property

|

1,50,000

|

1,50,000

|

|

Plant and Machineries

Less: Depreciation

|

1,10,000

|

1,70,000

|

|

Goodwill

|

15,000

|

5,000

|

|

Investment

|

75,000

|

1,30,000

|

|

Debtors

|

1,08,000

|

1,32,000

|

|

Stock

|

70,000

|

1,02,000

|

|

Bills Receivable

|

42,000

|

53,000

|

|

Cash in hand and at bank

|

20,000

|

50,000

|

|

Preliminary Expenses

|

20,000

|

15,000

|

|

|

6,10,000

|

8,07,000

|

|

|