1. (a) Give an example of a function, f(x), that has an in ection point at (1; 4).

(b) Give an example of a function, g(x), that has a local maximum at ( 3; 3) and a local minimum at (3; 3).

(c) Plot f(x) and g(x) on the same graph being sure to label the in ection point(s) and local extrema.

2. The Mendozas wish to borrow $300,000 from a bank to help �nance the purhcase of a house. Their banker has o�ered the following plansfor their consideration: �

(plan I) repay the loan in monthly installments over 30 years with interest on the unpaid balance charged at 6.09%/year compounded monthly;

(plan II) repay the loan in monthly installments over 15 years with interest on the unpaid balance charged at 5.76%/year compounded monthly.

(a) Compose a business letter to the Mendoza family describing each plan in detail and the impact each plan will have for the family nances. The letter should contain the following information and a full, detailed description of how each was calculated:

the monthly repayment for each plan;

the di�erence in total payments made under each plan.

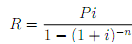

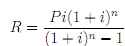

(b) Recall the amortization formula

where i is the interest charged per period, R the periodic payment on a loan, and P dollars to be amortized over n periods. Show that the amortization formula may be written as

(c) If they can a�ord $1600/month, what is the maximum loan amount that the Mendozas may make?