The payments on GPMs unlike the payments on traditional mortgages are not equal. The payments under GPMs start at a relatively low level and rise for a specified number of years and then become equal after the specified number of years. The level of steps of increase and the specified number of years after which the payments become equal depend upon the plan indicated in the mortgage agreement.

The terms of five popular plans are given in the table below:

Table 1: Graduated-Payment Mortgages

|

Plan

|

Term to Maturity

(in years)

|

Years that Payments Rise

|

Percentage Increase per year (%)

|

|

I

|

30

|

5

|

2.5

|

|

II

|

30

|

5

|

5.0

|

|

III

|

30

|

5

|

7.5

|

|

IV

|

30

|

10

|

2.0

|

|

V

|

30

|

10

|

3.0

|

The comparison between monthly payments under a GPM based on Plan III and those under a traditional mortgage for a loan of $100,000 at 10% interest is given below:

Table 2

|

Year(s)

|

Monthly Payment under GPM ($)

|

Monthly Payments under Traditional Mortgage ($)

|

|

1

|

667.04

|

877.58

|

|

2

|

717.06

|

877.58

|

|

3

|

770.84

|

877.58

|

|

4

|

828.66

|

877.58

|

|

5

|

890.80

|

877.58

|

|

6-30

|

957.62

|

877.58

|

GPMs are preferred by young first-home buyers whose current income is not sufficient to take on a large loan, but whose income is expected to increase rapidly in the near future.

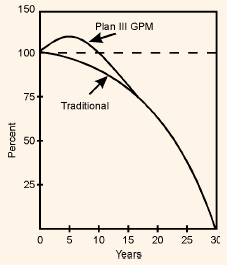

As GPMs have smaller initial payments than the traditional mortgages, they do not pay down their mortgage balances quickly. Another feature of GPMs is that the mortgage balance increases for a short period of time because smaller payments in the initial years do not even cover the interest and the shortfall is added back to the mortgage balance. However, with the increase in the monthly payments, mortgage balance gradually decreases and eventually reaches zero by the end of the term.

Figure 3: Comparison between Plan III GPM and a Traditional Mortgage

Figure shows the mortgage balance for a traditional and a plan III GPM. Under plan III GPM, mortgage balances increase for a particular period and then start declining.