Cash management is related along with the management of:

- Cash outflows and inflows of the firm

- Cash flows inside the firm

- Cash balances as financing deficit and investing surplus.

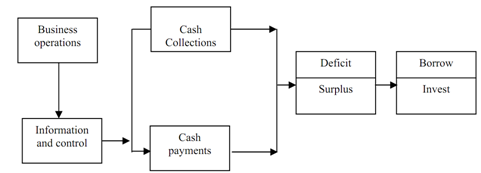

The process of cash management can be represented through the cash management cycle as demonstrated in the figure 1.

Figure: Cash Management Cycle

Sales produce cash that is used to pay for operating activities. The surplus cash has to be invested whereas deficit has to be borrowed. Cash management search for accomplish this cycle on minimum cost. At similar time it also search for achieve control and liquidity. Cash management assumes more significance than other current assets as cash is the least productive asset that a firm clutches; this is important as it is used to pay the firm's financial obligations. The major difficulty of cash management arises because of the difference in timing of cash outflows and inflows. So as to decrease this lack of synchronization in between cash payments and receipts the firm must develop appropriate strategies for cash management, encompassing the subsequent:

• Cash planning: Cash outflows and inflows must be planned. Estimates about cash outflows and inflows for the planning period must be made to project cash deficit or surplus. Cash budget must be prepared for this reason.

• Managing cash flows: Cash flows must be managed in such a manner that this accelerates cash inflows and delays cash outflows as much as possible.

• Optimum cash level: The firm must decide regarding the optimum cash balance, that it should keep. This decision needs a trade of among the cost of excess cash and the cost of cash deficiency.

• Investing surplus cash and financing deficit: Surplus cash must be invested in short-term instruments in order to receive profits along with continue liquidity. As the same, the firm must also plan in advance about the sources for finance short term cash deficit.

The cash management system design is affected by the firm's products organization structure, the competition, market and the culture wherein it operates. Cash management is not a standalone function although it needs close coordination, precise and timely inputs from different departments of the organization.