Example of Fixed Investment-ACCOUNTING SYSTEM

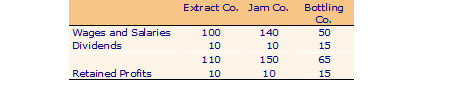

Consider again the economy in example III. An inventor offers to construct some machines for each of the three companies which would enhance productivity of their workers. The Jam Co. formed a subsidiary and appointed the inventor as its managing director. The three companies decided to retain half of their profits and invest them in the construction of machines. The inventor employed hitherto unemployed workers and paid them and himself out of the funds made available to him by the three companies. The three companies paid out the following incomes:

Total business savings : 35

Value of investment goods produced : 35

Aggregate consumption : 325 + 35 = 360

GNP = Consumption + Investment : 395

GNI = Wages and Salaries + Dividends + Retained Profits: 325 + 35 + 35 = 395

Note the following about this example:

Retained profits are regarded as factor incomes even though they are not paid out to households. Hence a new concept called Personal Income has to be defined.

Personal Income = GNI - Retained Profits

The aggregate consumption still remains at 360. However, now it is shared by a larger number of households. This is achieved by reducing the incomes available to profit earners. There is no sacrifice of aggregate consumption because unemployed labor was available to work on the construction of machines.

Investment goods, even though sold by one producing unit to other producing units, are not treated as intermediate inputs. Unlike raw materials they do not get used up in one year. In the year in which they are produced they are treated as part of 'final output'.

Now suppose, no unemployed labor was available when the investment project was proposed. Now investment will necessitate some sacrifice of consumption. Suppose all the three corporations divert 10 percent of their labor and entrepreneurial manpower to the subsidiary producing machinery. We will assume that this leads to 10 percent reduction in the output of extracts, chemicals, bulk jam and bottled jam. It is easy to show that at old prices the aggregate value of consumption goods is only 324. The value of income earned is 360 while the value of investment is 36. The point is, to finance the investment,

either households have to be induced to save to the extent of 36;

or they can be forced to save.

The former can be brought about by a national savings campaign. The latter through an increase in prices. If prices of extracts, chemicals, jam, etc. are raised by a factor (360/324) it is easy to show that the three old corporations will have 'windfall profits' of 12, 16, and 8 respectively which can be used to finance the construction of machines. Now GNP would be 360 (consumption) + 36 (investment), i.e. 396 while GNI is 360 (wages, salaries, dividends) plus 36 (undistributed windfall profits), i.e. 396. Note however that at the old prices value of GNP is 360.

Thus, we now have to distinguish between real and nominal GNP. The latter is measured at current year's prices, the former at a given base year's prices.

Nominal values include effects of changes in physical output as well as changes in prices. Real GNP attempts to measure 'real output', i.e. attempts to eliminate changes purely due to changes in prices.

Note that the saving of Rs.36 windfall profits by the corporations is not 'forced saving'. It is perfectly voluntary. 'Forced' refers to the fact that households had to accept an unplanned cut in their consumption through a reduction in the purchasing power of their money incomes.

Types of Business Savings: A Digression

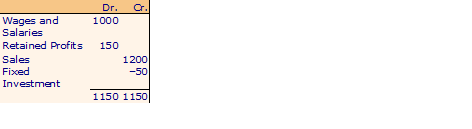

Retained profits are one form of business saving. What about depreciation provision? Consider an economy with two producing units. One of them called Consumption Co. starts with a new machine worth 500 and with labor worth 1000 produces consumption goods which are sold for 1200. The machine life is 10 years. The other company called Investment Co. produces a machine with labor worth 340 and sells it to consumption Co. for 500. Both companies retain all profits. The accounts can be set up as follows:

Investment Co.

Consumption Co.

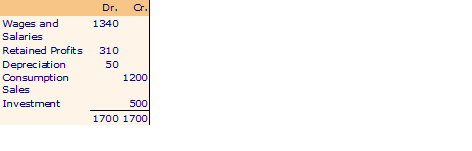

The item -50 in Consumption Co.'s account is depreciation (negative investment) calculated by the straight line method. It can be argued that even though in the last year's accounts the machine worth 500 was entered as a final product it is in fact an intermediate product. If the accounting period were 10 years, the entire machine would have been 'Consumed' within the productive process just like any raw material. Thus 50 should be deducted from Consumption Co.'s value of output to reflect this fact. After all ten one-year accounts should add up to one ten-year account.

However the customers have paid 1200 for Consumption Co.'s output and do not care about the notional adjustment for depreciation. Expenditures at market values are important. Also the saving of any sector should equal the enhancement in its net assets position. The depreciation provision of 50 is as much a source of funds as retained profits. Further accounting depreciation is not an appropriate measure of the loss of productive potential of an asset. Consumption Co.'s accounts should be presented as follows:

Consolidated Production Account

Thus GNP is 1700. We define a new concept called Net National Product (NNP) to reflect the fact that a productive asset has been depreciated in producing the GNP.

NNP = GNP - Depreciation

Thus GNP = Consumption + Gross Investment

NNP = Consumption + Net Investment

Depreciation is counted as part of gross value added.

GNI = Wages and Salaries + Dividends + Retained Profits + Depreciation

= Gross Value Added

Net National Income (NNI) = GNI - Depreciation

Personal Income = NNI - Retained profits