Suppose you get a cash bonus of Rs.1, 00,000 that you deposit in a bank that pays 10 % annual interest. How much can you withdraw yearly for a period of 10 years?

Solution:

From eq.13

A = PVAn * 1/PVIFA10%10

A = 1,00,000/6.145

A = 16,273

Present value of perpetuity:

Perpetuity is an annuity of an infinite duration

PVA∞ = A [(1/(1 + k) + 1/(1 + k)2+ ..................+ 1/(1 + k) ∞)]

PVA∞ = A . PVIFAk,∞

Here PVA∞ = Present value of a perpetuity

A = Constant annual payment

PVIFAk,∞ = Present value interest factor for perpetuity

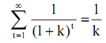

The value of PVIFAk,∞ is:

An annuity's present value for interest factor of infinite duration or perpetuity is simply 1 divided via interest rate as expressed in decimal form. The present value of an annuity is equivalent to the constant annual payment divided via the interest rate, for illustration, the present value of perpetuity of Rs.20, 000 whether the interest rate is 10 percent, is Rs. 2, 00,000.