Q. Evaluate optimum price of the new machine?

The optimum price will be the one which optimises total contribution over the five-year life of the new machine.

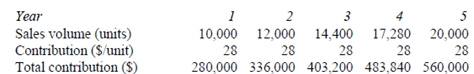

Sales price of $70 per unit

Contribution per unit = 70 - 42 = $28 per unit

Sales growth is 20% per annum

Year 5 sales volume is inadequate to the maximum capacity of the new machine

Total contribution over the five years is $2063040

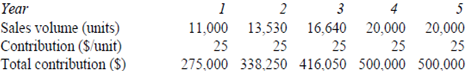

Sales price of $67 per unit

Contribution per unit = 67 - 42 = $25 per unit

Sales growth is 23% per annum

Sales volume is limited in years 4 and 5

Total contribution over the five years is $2029300

The sales price of $70 per unit seems to be marginally preferable on the basis of total contribution. The incremental fixed production expenses will be the same irrespective of which sales price is selected and so may be omitted from the analysis.