Estimate Fixed Overhead Variances

Referring to data, we can estimate the fixed overhead variances as given below:

|

Budget for December 2003;

|

Shs.

|

|

Fixed Overheads

|

11,480

|

|

Variable Overheads

|

13,120

|

|

Labour Hours

|

3,280 hours

|

|

Standard Hours of Production

|

3,280 hours

|

|

Actual Results for December 2003

|

Shs.

|

|

Fixed Overheads

|

12,100

|

|

Variable Overheads

|

13,930

|

|

Actual Labour Hours

|

3,150/hours

|

|

Standard Hours of Production

|

3,280 hours

|

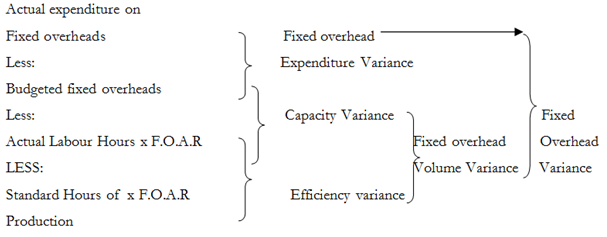

Fixed Overhead Expenditure Variance is:

= Actual Fixed Overheads - Budgeted Fixed Overheads

= Shs.12,100 - Shs.11,480 = Shs.620 (Unfavourable)

Fixed Overhead Capacity Variance is:

= Budgeted fixed Overheads - (Actual Hours x F.O. A. R)

= Shs.11,480 - (3,150 x 3.5) = Shs.455 Unfavourable

Fixed Overhead Efficiency Variance is:

= (Actual Hours x F.O.A.R) - (Standard Production Hours x F.O.A.R)

= (3,150 X 3.5) - #,230 X 3.5) = Shs.280 Favourable.

Fixed Overhead Volume Variance is:

= Fixed Overhead Capacity Variance + Fixed Overhead Efficiency Variance.

= 455 (U) + 280 (F) = Shs.175 (Unfavourable)

Fixed Overhead Variance is:

= Fixed Overhead Expenditure Variance + Fixed Overhead Volume Variance

= Shs.620 (Unfavourable) + Shs.175 (Unfavourable)

= Shs.795 (Unfavourable).

The approach described so long is the most generally used especially for examination. Another cause that the student must be confident enough along with so long for further insights the student could proceed to the given section.