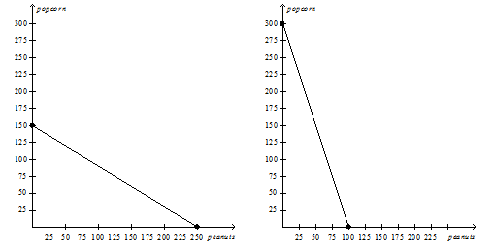

The only two countries in the world, Alpha and Omega, face the following production possibilities frontiers (all units measured in tons).

Alpha's Production PossibilitiesFrontier Omega's Production PossibilitiesFrontier

a) Which country has the absolute advantage in producing popcorn?

b) Which country has the absolute advantage in producing peanuts?

c) What is Alpha's opportunity cost of producing one ton of peanuts?

d) What is Omega's opportunity cost of producing one ton of peanuts?

e) Assume that each country decides to use half of its resources in the production of each good. Show these points on the graphs for each country as point A.

f) If these countries choose not to trade, what would be the total world production of popcorn and peanuts based on the points you drew?

g) Now suppose that each country decides to specialize in the good in which each has a comparative advantage. Who has the comparative advantage in peanuts?

h) Who has the comparative advantage in popcorn?

i) By specializing, what is the total world production of each product now?

j) If each country decides to trade 100 units of popcorn for 100 units of peanuts after specializing, show on the graphs the gain each country would receive from trade. Label these points B.