Equilibrium Income

In this model, aggregate desired expenditure has three components: Consumption, Investment and Government Expenditure:

E = C + I + G

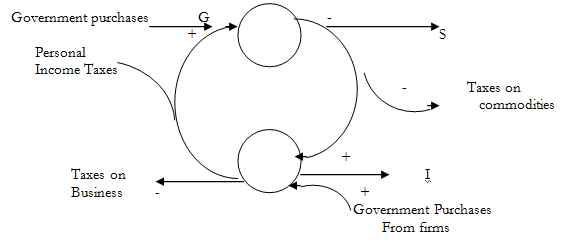

However, in the Governed Economy, taxes levied by the government are a second withdrawal. If the government taxes firms, some of what firms earn is not available to be passed on to households. If the government taxes households, some of what households earn is not available to be passed on firms. Whatever subsequently happens to money raised, taxes withdraw expenditure from the circular flow.

In the Governed Economy, however, government expenditure is a second injection. Such expenditure creates income for firms that does not arise from the spending of households, and it creates income for households that does not arise from the spending of firms. Whatever the source of funds, government spending injects expenditure into the circular flow.

Letting G stand for Government Expenditure, T for Taxes, J for injections and W for withdrawals, we can say the National Income is in equilibrium when total withdrawals, savings plus taxes, is equal to total injections, investment plus government expenditure. The equilibrium condition for national income can thus be written as:

W = J, or S + T = G + I