Whereas dividend may be of prime significance to some equity shareholders, this may not be so for the other shareholders. Several shareholders may be interested in receiving a usual cash income, whilst others may be more interested in securing capital gains by rising market prices. During comparing the merits of optional investment opportunities, we must therefore relate earnings and dividends per share to the market, value of shares. Dividends per share divided via market price per share would provide yield rate on equity shares. Dividend yield is of particular significance to those investors whose objective is to maximize the dividend income by their investments.

Earnings performance of equity shares is frequently expressed as price earnings ratio through dividing the market price per share through the annual earnings per share. Hence a share selling for Rs. 40 and having earnings of Rs. 5 per share in the year only ended may be stated to contain a price-earnings ratio of 8 times.

By assuming the 2,500 additional equity shares issued through the company on January 1, 2003 acquired the full dividend of 96 paisa in 2003, and additional assuming the price of the equity shares on December 31, 2002 and December 31, 2003 as specified in Table no.5, earnings per share and dividend yield might be summarized as given below:

Table no.5

Earnings and dividends per equity share

|

Date

|

Assumed

Market value per share

|

Earnings per share

|

Price- earnings

ratio

|

Dividend per share

|

Dividends yield %

|

|

Dec. 31, 2002

|

Rs.

18

|

Rs.

4.05

|

4.44

|

1.00

|

5.56

|

|

Dec. 31, 2003

|

14

|

2.64

|

5.30

|

0.96

|

6.86

|

The decline in market value throughout 2003 presumably reflects the reduction in earnings per share. The investors evaluating such shares at December 31, 2003 would see whether a price earnings ratio of 5.30 and the dividend yield of 6.86 shown a satisfactory situation in the light of optional investment opportunities. We can also compute the book value per share.

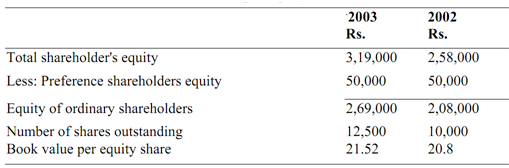

Table no.6

Book value per equity share

Book value points to the net assets shown by each equity shares. This information is useful in estimating a reasonable price for company shares, particularly for tiny companies whose shares are not publicly traded. Though, the market price of the shares of a company may considerably differ from its book value based upon its future prospects along with regard to earnings.

Long-term Creditors: Long-term lenders or creditors are primarily interested in two issues:

1. The firm's capability to meet its interest requirements.

2. The firm's capability to repay the principal of the debt while it falls due.

By the viewpoint of long-term creditors, one of the suits indicators of the safety of their investments might be the fact that, above the life of the debt, the company has adequate income to cover its interest needs by a broad margin. A failure to recover interest needs may have serious solvency of the firm and repercussions on the stability. A general measure of the debt safety is the ratio of income obtainable for the payment of interest to annual interest expenses, termed as number of time interest earned. Such computation for Megapolitan Company would be as given below:

Number of Times Interest Earned

2003 2002

Rs. Rs.

Operating income (before interest and income taxes) a) 63,500 80,000

Annual interest expense b) 12,000 15,000

Times interest earned (a - b) 5.29 5.33

Long-term lenders or creditors are interested in the amount of debt outstanding in association to the amount of capital contributed through shareholders. The debt ratio is calculated through dividing long-term debt via shareholders equity as demonstrated below:

Debt Ratio

2003 2002

Rs. Rs.

Long-term/debt a) 1,00,000 1,25,000

Shareholders equity b) 3,19,000 2,58,000

Debt ratio (a - b) 31.35 48.45

By creditors' point of view, the lower the debt ratio or higher the equity ratio the suitable it is. The lower debt implies the meaning that the shareholders have contributed a great size of funds to the business and thus the margin of protection to creditors against shrinkage of assets is improved.