Billsby Corporation had a tax liability for 20X7 of $20,000 based on a tax rate of 40%, but the accounting staff needs your help in determining the tax expense and deferred tax amounts for 20X7. The enacted tax rates for the future periods are 35% for 20X8 - 20Y2, and then 30% for 20Y3 - 20Y6. The company does not believe that temporary differences can be reasonably projected beyond those periods. The taxable income for 20X8 was $100,000. Billsby also owned a 30% interest in Windrop, Inc. which reported income of $50,000 and $60,000 in 20X7 and 20X8, respectively. Billsby received dividends of $5,000 and $8,000 from Windrop for 20X7 and 20X8, respectively. Billsby expects this pattern of earnings and dividends to continue over the next ten years. Billsby estimated warranty expense to be $7,500 in 20X7 and $10,000 in 20X8. Actual warranty cost for the two years was $6,000 and $12,000, respectively. The bad debts expense recognized on the income statement was $15,000 in 20X7 and $20,000 in 20X8. Actual bad debt write-offs per the tax return were $10,000 in 20X7 and $15,000 in 20X8. On January 1, 20X8 Billsby also received $30,000 of rent in advance covering a two year rental agreement, and $5,000 for interest income on municipal bonds (classified as held-to-maturity securities). The bonds mature in 20Y0.

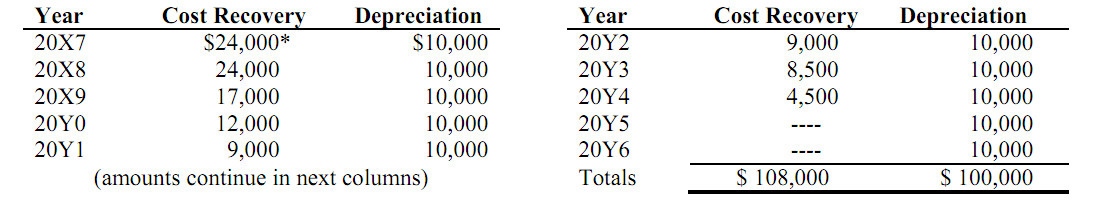

Other data with respect to Billsby's depreciation expense calculations is as follows:

Required:

a. Determine the tax expense and the deferred tax amounts for 20X7 and 20X8. Be sure to separate current and long-term amounts and to present amounts before and after netting.

b. Determine the tax liability amount for 20X8.

c. Prepare all necessary journal entries for the two year period (20X7 - 20X8).

d. Prepare a partial income statement for 20X7 showing earnings before tax, provision for income tax, and net income.

(A good example of this format would be schedule M-1 from a corporate income tax return)