Q. Describe Modigliani and Miller Approach of Capital Structure?

Ans. Modigliani as well Miller Approach: - The Modigliani-Miller approach is alike to the net operating income approach when taxes are ignored. Nevertheless when corporate taxes are assumed to exist their hypothesis is alike to the Net Income approach.

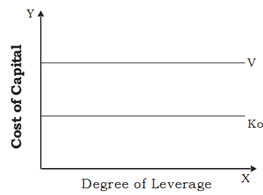

(1) The Modigliani and Miller Approach-When the taxes are ignored: - The speculation propounds that a change in capital structure doesn't affect the overall cost of capital and the total value of the firm. The reason following the theory is that although the debt is cheaper to equity with the increased use of debt as a source of finance the cost of equity increases as well as this increase in the cost of equity offsets the advantage of the low cost of debt.

Therefore although the change in the debt-equity ratio affects the cost of equity the overall cost of capital stays constant. The theory additional propounds that beyond a certain limit of debt the cost of debt increases but the cost of equity falls thereby once more keeping the overall cost of capital constant.

Graphic Presentation:-

Assumptions: - MM approach is on the basis of following assumptions:

(i) Securities are traded in a perfect capital market situation.

(ii) There are no corporate taxes

(iii) All the investors have similar expectations about the net operating income of the firm.

(iv) The cut off rate of investment in a firm is the capitalization rate.

(v) All the earnings are dispersed to the shareholders

(vi) Firms is able to be grouped into homogeneous risk classes.