Critical Thinking about Cost Flow

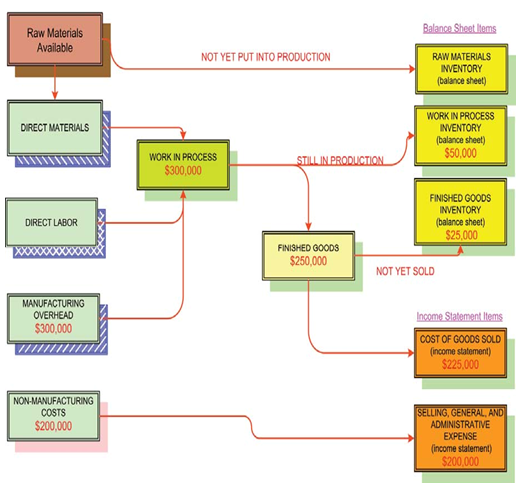

It is simple to overlook an important aspect of cost flow within a manufacturing operation. If you see that have taken note of an important concept! Try to give solution to this seemingly easy question: Is downgrading an expense? You are almost certainly inclined to say yes. Other than, the fact of matter is that the solution depends! Let's think this with an instance. Assume that Altec Corporation calculated deprecation of $500,000 for 20X1. 60% of this depreciation pertained to the manufacturing/constructing plant, and 40% related to corporate offices. More, Altec sold 75% of the goods place into production during the year. One third of the remaining goods placed in the production house were in finished goods awaiting resale, and the other portion was still being processed in the factory/industry. So, what do you understand by accounting implication? How does this all shake out? Let's re-examine the above drawn diagram -- this time with flow of the $500,000 of depreciation superimposed (for this illustration, we ignore all other costs and looking only at depreciation piece/part):

At first, notice that the $500,000 of depreciation cost enters the cost pool on left; $300,000 attributable to manufacturing ($500,000 X 60%) and $200,000 to nonmanufacturing ($500,000 X 40%). The nonmanufacturing depreciation is a time cost and completely makes its way to expense on the right side of graphic. Other than, the manufacturing depreciation follows a much protracted journey. It is assigned to work in the process, and 75% of the goods put in process end up being completed and sold by end of the year. Hence, $225,000 of the $300,000 ($300,000 X 75%) is charged against the income as price of goods sold. The other $75,000 ($300,000 - $225,000 cost of goods sold) remains somewhere in the inventory/factory. In our fact situation, 1/3 of the $75,000 ($25,000) is attributable to the completed goods and becomes part of the finished goods inventory/factory. The other $50,000 ($75,000 x 2/3) stays in work in process inventory because it is attributable to units still in production.

Is it puzzling enough? The base line here is that only $425,000 of depreciation was charged against the income. The other $75,000 was given to work in the process and finished goods inventory. In short, $500,000 ($300,000 + $200,000) entered on the left, and $500,000 can be obtained on the right ($50,000 + $25,000 + $225,000 + $200,000). Coming back to the seemingly simple query, we see that the cost is not always an expense in the same time period. In a manufacturing business, much of the direct labour, direct material, and factory overhead can end up in inventory -- at least until that particular inventory is disposed.

How much importance does these cost flow concepts contain? Well, they are significant enough that the FASB has specified external reporting rules desiring the allocation of the production overhead to inventory. And, for tax purposes, the IRS have specific "uniform capitalization" rules. Under these rules, inventory must soak up direct labour, direct materials, and indirect costs of including indirect labour, pensions, employee benefits, indirect materials, handling, storage, purchasing, depreciation, rent, insurance, utilities, taxes, repairs, design cost, tools, and there is a long list of other factory overhead items. A company's results of operations are sensitive to the proper cost assignment, and management accountants are focused on the processes for correctly calculating and capturing this information. Subsequent topics will better acquaint you with this kind of aspect of accounting.