i) Briefly distinguish between the Cournot duopoly model and that of Stackelberg.

ii) Suppose the inverse market demand curve for a telecommunications equipment is P = 100 - 2Q. Suppose there are two firms with constant marginal cost $4. Assuming they behave as Cournot duopolists, what will be the price and total industry output?

iii) The inverse market demand curve for a Stackelberg leader and follower is given by P = 30 - Q. If each has a marginal cost of $2, what will be the equilibrium quantity and price for each producer?

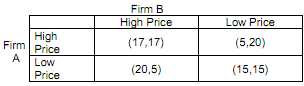

iv) Two firms, A and B, are operating in the US market industry under duopolistic condition and choose to either produce at "High" price or a "Low" price. Suppose you are the manager of firm A and you are required to advise the Board of Directors about the following strategic options:

a. If Firm B chooses High Price, what is Firm A's best strategy and why?

b. If Firm A chooses Low Price, what is Firm B's best strategy and why?

c. What is the Nash equilibrium? Explain.

d. What measures could you adopt to convince Firm B that you will abide to the agreement?

e. Suppose that both firms produce at "Low" price and each firm make a loss of 16.