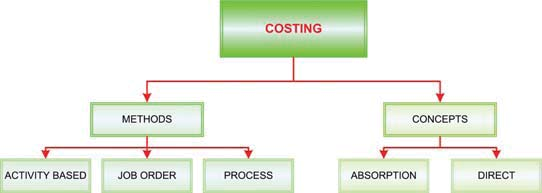

Costing

Cost accounting can be described as the collection, interpretation of cost and assignment. In succeeding chapters, you will learn about alternative costing techniques. It is important to know what the products and the services cost to produce. The ideal approach to capturing costs is relied on what is being produced.

Costing Methods -- In some settings, costs can be captured by "job costing method." For instance, the conventional home maker would likely capture costs for the each house constructed. The actual labour and material which goes into each house would be tracked and assigned to that particular home along with some similar amount of overhead, and the cost of each home can be likely to vary considerably.

Some of the companies produce homogenous products in the continuous processes. For instance, consider the costing issues faced by companies which produce the lumber, bricks, paint or other such homogenous components used in construction of a home. How much does each piece of lumber, or stack of bricks, cost bucket of paint? These types of items are created in continuous processes where costs of all these are pooled together during the production and the result is measured and calculated in aggregate quantities. It is difficult to see the specific costs attaching to the each and every unit. Yet, it is essential to make the cost assignment. To deal with these types of situations, accountants must utilize the "process of costing methods."

At the present, let's think about the architectural firms which design homes. Such organizations are required to have a sense of their costs for purposes of the billing clients, but the firm's activities are very much complex. An architectural firm must employ in many activities that drive costs but do not create revenues. For instance, substantial effort is needed to train staff, bill and collect, maintain the office, develop clients, print plans, visit job sites, consult on problems identified during construction, etc.The individual architects are probably drawn in multiple tasks and projects throughout day; therefore, it becomes very difficult to say exactly how much it costs to develop the set of blueprints for the specific client! The firm may consider tracing costs and assigning them to the activities such as training client development, etc.). Then, allocation model or body can be used to attribute activities to jobs, enabling a reasonable cost assignment. These "activity-based costing" (ABC) systems can be used in number of settings, but are on the whole well suited to situations where overhead is high, and a variety of products and the services are produced.

Costing Concepts -- In addition to the alternative techniques of costing, a good manager will be required to understand different theories and concepts about costing. In a basic sense, approaches can be described as the "absorption" and the "direct" costing concepts. Beneath the absorption concept, a product or service will be assigned its full cost, including the amounts which are not easily identified with the particular item. Overhead items which are sometimes called "burden" include the facilities depreciation, maintenance utilities, and many other equivalent shared costs. With the absorption costing, this overhead is schematically allocated among all the units of output. Or we can say that the output absorbs the full cost of productive process. Absorption costing is needed for the external reporting purposes under the commonly accepted accounting principles. But, some managers are aware of the fact that sole reliance on absorption costing numbers can lead to the bad decisions.

Result of which, internal cost accounting processes in some of the organizations focus on the direct costing approach. With the direct costing, the unit of output will be assigned only to its direct cost of production such as direct materials, direct labour, and the overhead that happen with each unit produced. You will study the differences between the absorption and the direct costing, and consider that how they influence the process of management decision. It is one of the useful business decision elements to understand the -- empowering you to make good decisions. Future chapters will be building your understanding of these concepts. In the review, to properly direct the organization needs a keen sense of the cost of the products and the services. Costing can happen under number of methods/techniques and theories, and a manager should understand when and how these methods/techniques are best utilized to facilitate the decisions which must be made. Large portions of the following topics will focus on these cost accounting issues.