Cost of Preference capital (K )

The fixed rate of dividend payable to the Preference share holders is the cost of Preference capital. Exactly, the cost of Preference capital is a function of dividend expected by its investors.

K = D /NP

Where, K = cost of Preference capital, D = Annual Preference dividend and NP =

Preference share capital ( Net proceeds).

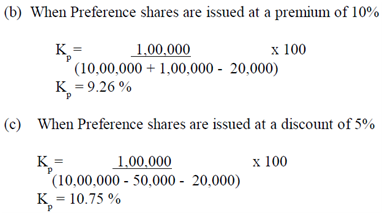

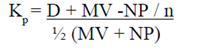

Occasionally, when the issue of Preference shares involves a discount or a premium the proceeds are adjusted accordingly. When the Preference shares issued are redeemable in nature,

Where, K= cost of redeemable Preference capital, D = Annual Preference dividend, MV = Maturity value of Preference shares and NP = Net proceeds of Preference shares

Illustration:

A Co. issues 10,000, 10% Preference shares of Rs.100 each. Cost of issue is Rs.2 per share. Calculate cost of Preference capital if these shares are issued (i) at par (ii) at a premium of 10% and (c) at a discount of 5%

Solution: K = D /NP

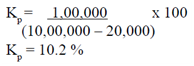

(a)When Preference shares are issued on par