Problems for Benchmark HW: There are issues here that were not covered in live lecture, but here are some issues that you need to be conscious of when attempting the problems.

t Deficit in CEP may create and issue of netting between AEP & CEP

t Property Issues: Sale of assets may cause an increase in the current years E&P

1A)

ISH AB = $40

ISH % ownership = 50%

CSH AB = $100

CSH % ownership = 50%

On April 2, 2010 (one-fourth of the way through the year), D Corp makes a distribution of $100 to Shareholders. A $100 distribution is declared on 12/1/2010, payable on 12/31/2010 to SHs of record on 12/15/2010. D Corp mails a $100 check to CSH and a $100 check to ISH on 12/31/2010. The checks are received by CSH and ISH on 1/3/2011. Reg. § 1.451-2(b), Reg. § 1.301-1, Rev. Rul. 64-290, Rev. Rul. 62-131.

When do the SHs have income? On date of 1/3/2011, shareholders will have income. According to Reg. § 1.451-2(b), If payment is made on 12/31/10 does not constitute constructive receipt until the payment is received which was 1/3/2011.

When Does D Corp. Reduce its E & P? On date of April 2, 2010 and 1/3/2011. Section 1.561-2 states that a dividend will be considered as paid when it is received by the shareholder. A deduction for dividends paid during the taxable year will not be permitted unless the shareholder receives the dividend during the taxable year for which the deduction is claimed.

1B)

ISH AB = $40

ISH % ownership = 50%

CSH AB = $100

CSH % ownership = 50%

CEP= $100

AEP = ($100) (this is a deficit)

Dates of Distributions:

4/1/10, 12/1/10

On April 2, 2010 (one-fourth of the way through the year), D Corp makes a distribution of $100 to Shareholders. A $100 distribution is declared on 12/1/2010, payable on 12/31/2010 to SHs of record on 12/15/2010. D Corp mails a $100 check to CSH and a $100 check to ISH on 12/31/2010. The checks are received by CSH and ISH on 1/3/2011.

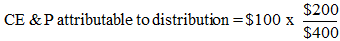

Now Suppose: D Corp has 2010 current E&P of $100 and an accumulated deficit of $100 in its E&P account as of 12/31/2010. Is the distribution declared on 12/1 and payable on 12/31/10 a dividend to the SHs or is the CEP offset by the deficit AEP yielding a return of capital for '11? Calculate the allocation of distributions.

If the current E&P is positive and the AEP is negative, the CEP does not offset the AEP and the distributions will be considered a taxable dividend up to the amount of the CEP.

D Corporation

CE&P $100

Accumulated deficit ($100)

=$200

See: Rev. Rul. 74-164. & Rev. Rul. 65-23

1C)

ISH AB = $40

ISH % ownership = 50%

CSH AB = $100

CSH % ownership = 50%

CEP= $0

AEP = 100

Dates of Distributions:

4/1/10, 12/1/10

On April 2, 2010 (one-fourth of the way through the year), D Corp makes a distribution of $100 to Shareholders. A $100 distribution is declared on 12/1/2010, payable on 12/31/2010 to SHs of record on 12/15/2010. D Corp mails a $100 check to CSH and a $100 check to ISH on 12/31/2010. The checks are received by CSH and ISH on 1/3/2011.

Now suppose: suppose D Corp's Acc' E&P as of 12/31/2010 was $100 and its current E&P in 2006 is $0. ? Calculate the allocation of distributions.

1D)

ISH AB = $40

ISH % ownership = 50%

CSH AB = $100

CSH % ownership = 50%

CEP= $(120) deficit

AEP = 100

Dates of Distributions: 4/1/10, 12/1/10

On April 2, 2010 (one-fourth of the way through the year), D Corp makes a distribution of $100 to Shareholders. A $100 distribution is declared on 12/1/2010, payable on 12/31/2010 to SHs of record on 12/15/2010. D Corp mails a $100 check to CSH and a $100 check to ISH on 12/31/2010. The checks are received by CSH and ISH on 1/3/2011.