Q. Calculate break-even level of sales volume and revenue?

Z-Boxes sell for £299 and their variable production cost is £99. Research and development, and fixed production overheads for the year are£1.2 million.

a) Calculate break-even level of sales volume and revenue?

b) Calculate break-even revenue using C/S ratio?

c) Budget revenue is £2.99 million; calculate margin of safety in units and as a percentage?

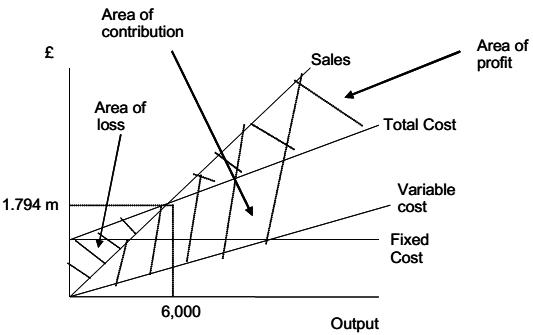

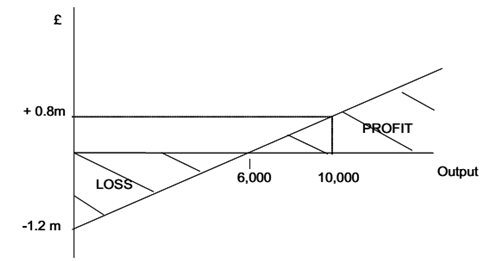

d) Produce a break-even chart and profit-volume chart using above information?

e) How many Z-Boxes should be sold to achieve £500,000 profit?

Solution:

a) 1.2 million/ £200 = 6,000 units, 6,000 units x £299 = £1,794.000

b) £1.2 million/0.6689 = £1,793,990

c) £2.99 million/£299 = budget volume 10,000 (10,000 - 6,000 = 4,000 margin of safety) or (4,000/10,000 = 40%)

d) See charts below

e) (1.2m + 0.5m)/£200 = 8,500 units