Reference no: EM13379542

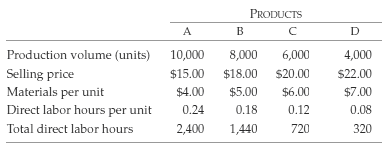

Youngsborough Products, a supplier to the ... Youngsborough Products, a supplier to the automotive industry, had seen its operating margins shrink below 20% as its customers put continued pressure on pricing. Youngsborough produced four products in its plant and decided to eliminate products that no longer contributed positive gross margins. The total plant overhead cost is $122,000 per year. Details on the four products are provided here:�

Youngsborough calculates a plantwide overhead rate by dividing total direct labor hours into total overhead costs. Assume that plant overhead is a fixed cost during the year, but that direct labor is a variable cost. The direct labor rate is $30 per hour.

Required

(a) Calculate the plantwide cost driver rate and use this rate to assign overhead costs to products. Calculate the gross margin for each product and calculate the total gross margin.

(b) If any product is unprofitable in part a, drop this product from the mix. Recalculate the cost driver rate based on the new total direct labor hours remaining in the plant and use this rate to assign overhead costs to the remaining three products. Calculate the gross margin for each product and calculate the total gross margin.

(c) Drop any product that is unprofitable with the revised cost assignment. Repeat the process, eliminating any unprofitable products at each stage.

(d) What is happening at Youngsborough and why? How could this situation beavoided?