Reference no: EM13371491

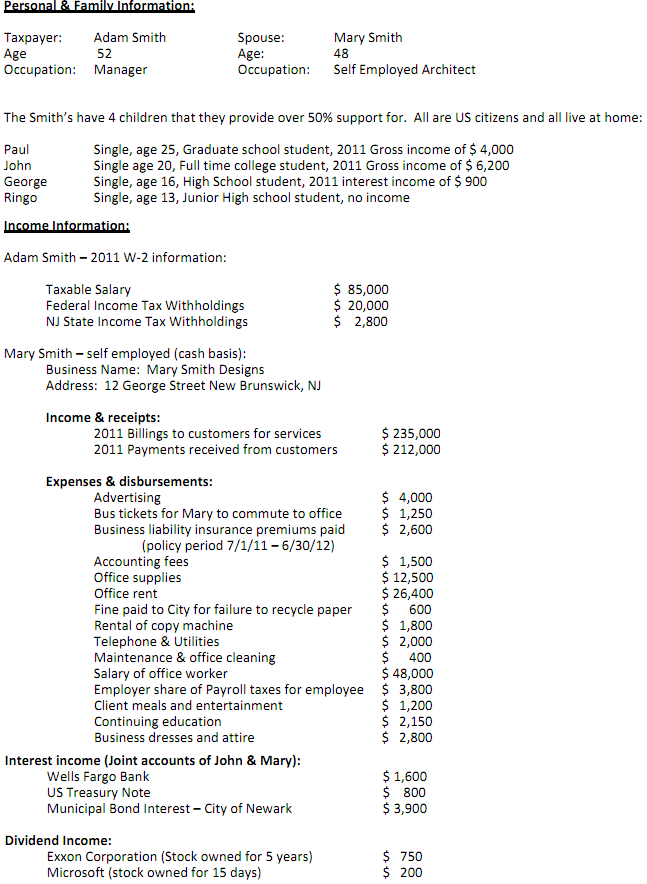

You are a CPA in New Jersey and a client of yours asked for a meeting to discuss tax issues and to have you prepare their 2011 Individual Federal Income tax return (Prepare a tax return for Adam & Mary only...not the kids).

Mary received a 10% stock dividend on her 200 shares of XYZ corporation stock. XYZ announced this pro rata stock dividend to all holders of its common stock on 5/1/11 when the stock was trading at $ 35 per share. She received the 20 new shares on 8/1/11 when the stock was trading for $ 30 per share.

Rental Income:

Adam & Mary own a plot of land in New Brunswick. They lease this lot to Quick Check, who uses the land as a parking lot for its customers. Quick Check paid the Smith's $ 30,000 in rental income in 2011. The Smith's paid $ 8,200 in real estate taxes, $ 2,150 in insurance, and $ 2,400 in maintenance costs.

Property transactions:

1. On 6/30/2011 Mary sold 200 shares of Microsoft, receiving $ 5,900 ($ 6,000 sales price less a $ 100 brokerage commission). Mary purchased these 200 shares on 6/15/2011 for $ 6,000.

2. On 9/15/2011 Adam sold 140 shares of Google Stock for $ 72,000 before a brokerage commission of $ 250. Adam inherited this stock on 3/12/2011 due to the death of his Uncle. The value of Google stock on the date of death was $ 500 per share. Adam's Uncle purchased the 140 shares on 7/12/2004 for $ 40,000.

3. Mary sold 300 shares of BP inc on 1/3/2011 to a neighbor for $12,900 (its fair market value). Mary purchased the shares on 5/18/2008 for 13,250.

4. Mary sold 50 shares of Apple stock on 9/15/2011 for $ 15,000. Her broker did not charge a commission. Mary received this stock as a gift from her sister on 5/1/2008. The value of the stock on 5/1/2008 was $ 12,000. Mary's sister paid $ 10,000 for the stock on 4/10/2005.

5. On 10/15/11 Mary sold some personal jewelry that her mother gave to her. Mary sold a bracelet for $ 2,000. Mary's mother purchased the bracelet at a flea market for $ 2,500 on 11/20/08. The bracelet was appraised at $ 3,000 on 12/24/08 when the bracelet was given to Mary.

Other Taxpayer Income Items:

1. Adam received $ 50 for Jury duty services during 2011.

2. Mary received a cash gift from her mother of $ 15,000.

3. Besides the Google stock that Adam inherited (see 2 above), he also received $ 100,000 cash on 3/15/2011 as beneficiary to a life insurance policy owned by his uncle naming Adam as beneficiary.

The Smiths also gave you the following information pertaining to 2011:

Adam contributed $ 300 per month to his traditional IRA in 2011, Mary contributed $ 5,000 to her traditional IRA on 11/12/2011. Both Adam and Mary are not covered by qualified retirement plans through employers.

Mary paid $ 6,000 per quarter ($ 24,000 total) in 2011 Federal Estimated Tax Payments - all paid in 2011.

Unreimbursed medical & dental expenses paid in 2011 totaled $ 3,660

NJ State Income taxes paid in on 4/15/11 for 2010 tax return totaled $ 400

Real estate taxes paid totaled $7,800

Condo maintenance fees paid in 2011 totaled $ 2,400

Mortgage Interest paid on their condo totaled $ 6,200

Interest paid on auto loans totaled $ 680

Credit card interest paid was $ 130

Gifts to charities for 2011 totaled $ 2,300

Gifts to family members totaled $ 3,600

Gifts to Political parties totaled $ 1,000

Gifts to an unemployed member of Mary's church totaled $ 1,200

Adam's gambling losses totaled $ 800 in 2011.

Tax preparation fees paid during 2011 totaled $ 600

1. Prepare the 2011 Federal Individual Income Tax return for Adam & Mary Smith, based on the information supplied above. You may use tax software, OR you may manually prepare the return using the correct IRS forms for 2011. Forms are available for download at irs.gov. You will need the following forms:

- Schedule A (Itemized Deductions)

- Schedule B (Interest & Dividends)

- Schedule C (Profit or Loss from Business)

- Schedule D (Capital Gains & Losses)

- Schedule 8949 (or a schedule of short term and long term capital gains and losses) to support entries on Schedule D.

- Schedule E (Supplemental Income and Loss - Rental Real Estate)

- Schedule SE (Self Employment Tax)

Be sure to follow IRS Form Instructions, especially when calculating the tax.

2. Please understand your tax return submission MUST be your own original work, This IS NOT a group project.