Reference no: EM131392867

Economics and Industry Analysis - Macroeconomics Assignment

Part A -

Q1. On Monday September 29th, 2008, "the House of Representatives defeated the proposed $700 billion mortgage-rescue plan ... Its rejection sent stock markets into freefall. The Dow Jones Industrial Average finished down by 7%, and suffered its biggest-ever points loss. ... The S&P closed 29% below its peak."

Imagine that on Monday afternoon (that is, before markets recovered on Tuesday) your boss stormed into your office, seeking your opinion regarding possible macroeconomic implications.

a. If the U.S. were a closed economy (an autarky), which component(s) of GDP could be affected by the stock market news? Explain briefly why it/they could be affected, and in which direction(s) (i.e., increase or decrease?).

b. Based on your answer in (a), would you expect a change in unemployment? If so, which type(s) of unemployment (structural, cyclical, frictional) would you expect to change, and in which direction(s)?

c. In general, could both the unemployment rate and total employment in the economy go up at the same time? Explain.

d. Given that the U.S. is not a closed economy, which additional component(s) of GDP could be affected (and in which direction) under the hypothetical assumption that the rest of the world is unaffected by news from Wall Street?

e. How would your answer to (d) change given that the rest of the world does not ignore news from Wall Street?

f. Imagine the following scenario: Country A is an open economy. One day, domestic consumers in Country A lose confidence and hence spend less on both domestically-produced and imported goods. Assuming for simplicity that exports did not change, this causes NX in Country A to go up. Would GDP increase, decrease, or remain the same? Explain why.

Q2. The following two graphs are reproduced from parts of Figures 5.3 and 5.4 of a previous edition of the textbook.

a. The graphs show that financial investors who bought three-month U.S. government bonds in 1975 got a negative real rate of return on their investment. It seems puzzling that people would choose to lend their money to the government to get a negative real rate of return. Can you explain their behavior?

b. In retrospect, would they have been better off holding their investment in cash instead of buying these bonds? Explain.

c. If your nominal wage grew 5% a year, would your real wage grow faster in 1980 or in 2000? Explain.

Q3. In a Goldman Sachs research paper titled "Dreaming With BRICs: The Path to 2050" (October 1, 2003), the authors write:

As developing economies grow, they have the potential to post higher growth rates as they catch up with the developed world. ... As countries develop, these forces fade and tend to slow towards developed country levels. ... This is why simple extrapolation gives silly answers over long timeframes.

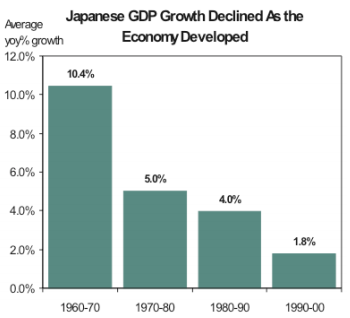

As a historic example, the authors provide the following graph:

a. What two factors are most often suggested as the reason for underdeveloped countries' potential to post higher growth rates than developed ones?

b. Can you list at least two demographic factors that played an important role in affecting long-term GDP growth in the U.S. (or in your country) during the period shown in the graph?

Q4. Think of the saving market in a country whose population is retiring. Assume that this has negligible effects on the investment curve, but that national household saving goes down as retiree households switch from positive to negative saving rates.

a. Would this increase, decrease, or not affect domestic investment? Explain (using S-D terminology). Are such developments in the saving market related to long-run growth? Explain

b. Why would you care as a short-term investor whose current portfolio consists of bonds? As a long-term investor whose current portfolio consists of equity? As a student paying loans (or mortgage) right now?

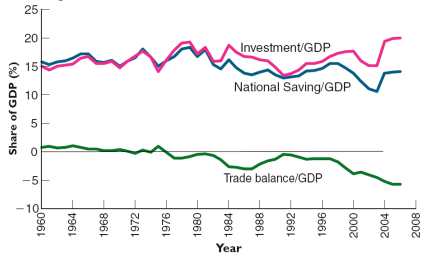

Q5. The graph below reproduces Figure 16.10 from a previous edition of the textbook (for an update, compare it to Figure 17.5 in your textbook). It is titled: "National Saving, Investment, and the Trade Balance in the United States, 1960-2006"

a. If U.S. national saving remained at current levels but investment (or gross investment) went down to, say, roughly 5% of GDP, the trade balance (or current account) deficit would become a surplus. In your opinion, how would such a development affect long-run U.S. growth rates? How would it affect national wealth in the short-run?

b. If China decided to spend its reserves on importing technology from the U.S. (say, buying U.S.-manufactured machines or IT services), how would you expect it to show on the graph for the U.S. economy? Show this qualitatively on the graph above by extending the three lines representing I, S, and NX (Canadian students, read: GI, S, and CA) to the right. Explain.

Part B -

Visit the "Commanding Heights" website (www.pbs.org/wgbh/commandingheights/hi/index.html → "Storyline" → (Episode One) "> see the chapter menu". Watch Chapter 4 (you may start with "New York in the 1920's"), Chapter 5, and Chapter 6 (until "London 1944"). If you experience technical problems with the PBS website, you can also watch these chapters at https://www.youtube.com/watch?v=DoWbm8zUG6Y (start at minute 20:33 and stop at minute 34:09).

1. According to the storyline, what were some of the channels through which Black Thursday (Oct. 24, 1929) dragged the U.S. economy (and with it, the world economy) into a recession?

2. Can you illustrate this on an AD-AS diagram? Can you think of smaller-scale parallels from the past few decades (not the Great Recession)?

3. According to the discussion in class, governments can attempt to close recessionary gaps through (a) instilling confidence, (b) fiscal policy, and (c) monetary policy. According to the video, which of these (more than one!) did the Roosevelt administration attempt? Can you think of smaller-scale parallels from the past few decades (including the Great Recession)?

4. Which of the administration's policies (prior to the war) were prescribed by Keynes's theory?

5. Eventually, WWII began. Can you illustrate its effects on the U.S. economy on an ADAS diagram?

6. Bonus question: Milton Friedman (a Nobel laureate in economics) claimed-and Ben Bernanke later agreed-that the Fed had failed to implement the right monetary policies that could have prevented the depression from having been so long and devastating. In your opinion, what would those right monetary policies have been?