Reference no: EM131149080

Complete the following problem in Microsoft® Excel® :-

1. Compute Bond Price Compute the price of a 3.8 percent coupon bond with 15 years left to maturity and a market interest rate of 6.8 percent. (Assume interest payments are semiannual.) Is this a discount or premium bond?

2. Yield to Maturity A 5.65 percent coupon bond with 18 years left to maturity is offered for sale at $1,035.25. What yield to maturity is the bond offering? (Assume interest payments are semiannual.)

3. Value a Constant Growth Stock Financial analysts forecast Safeco Corp.'s (SAF) growth rate for the future to be 8 percent. Safeco's recent dividend was $0.88. What is the value of Safeco stock when the required return is 12 percent?

4. Expected Return Ecolap Inc. (ECL) recently paid a $0.46 dividend. The dividend is expected to grow at a 14.5 percent rate. At a current stock price of $44.12, what is the return shareholders are expecting?

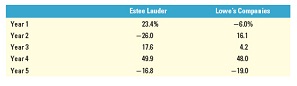

5. Risk, Return, and Their Relationship Consider the following annual returns of Estee Lauder and Lowe's Companies:

Compute each stock's average return, standard deviation, and coefficient of variation. Which stock appears better? Why?