Reference no: EM131318115

NONCASH CHARGES

Owens Corning Fiberglass Corporation

For Immediate Release (February 6, 1992)

Owens Corning Takes $800 Million Non-Cash Charge to Accrue for Future Asbestos Claims

"This action demonstrates our desire to put the asbestos situation behind us," new chairman and CEO Glen H. Hiner says.

Toledo, Ohio, February 6, 1992-Owens Corning Fiberglass Corp. (NYSE:OCF) today announced that its results for the fourth quarter and year ended December 31, 1991, include a special non-cash charge of $800 million to accrue for the estimated uninsured cost of future asbestos claims the Company may receive through the balance of the decade. "This action demonstrates our desire to put the asbestos situation behind us," said Glen Hiner, Owens Corning's new chairman and chief executive officer. "After a thorough review of the situation with outside consultants, we believe this accrual will be sufficient to cover the company's uninsured costs for cases received until the year 2000. We will, of course, make adjustments to our reserves if that becomes appropriate, but this is our best estimate of these uninsured costs. With this action," Mr. Hiner continued, "everyone can now focus once again on the fundamental strengths of the Company. We generate considerable amounts of cash, our operating divisions are leaders in every market they serve throughout the world, and we have taken a number of steps in the last few years to strengthen our competitive position even further."

Owens Corning Fiberglass Corporation

For Immediate Release (June 20, 1996)

Owens Corning Initiates Federal Lawsuit, Records Post-1999 Asbestos Provisions and Announces Dividend

NEW YORK, New York, June 20, 1996-A federal lawsuit aimed at fraudulent testing procedures for asbestos-related illnesses, involving tens of thousands of pending cases, was filed yesterday by Owens Corning. The Company also announced the quantification of liabilities related to post-1999 asbestos claims, the reinstatement of an annual dividend and a sales goal of $5 billion by 1999.

The specific announcements are as follows:

• A lawsuit, alleging falsified medical test results in tens of thousands of asbestos claims, was filed on June 19, 1996, in the U.S. District Court for the Eastern District of Louisiana against the owners and operators of three pulmonary function testing laboratories. Overall, a total of 40,000 cases may be impacted by the investigation for fraudulent testing procedures. The lawsuit is the subject of a separate press release also disseminated this morning.

• A net, after-tax charge of $545 million, or $9.56 per fully diluted share for asbestos claims-received after 1999-will be recorded in the second quarter of 1996, as detailed in a Form 8-K filed this morning with the SEC. Cash payments associated with this charge will begin after the year 2000 and will be spread over 15 years or more.

• The Board of Directors has approved an annual dividend policy of 25 cents per share and declared a quarterly dividend of 6-1/4 cents per share payable on October 15, 1996, to shareholders of record as of September 30, 1996.

• The company expects to reach its sales goal of $5 billion in 1999-a full year ahead of the original goal.

The original goal. "The asbestos charge quantifies what we expect to be the cost to Owens Corning of post-1999 claims," stated Glen H. Hiner, chairman and chief executive officer. "We further believe that the present value of the Owens Corning asbestos liability, including the current charge, is less than the current discount in our stock price."

In addition to these developments, Owens Corning announced it is engaged in substantive discussions with 30 of the principal plaintiff law firms in an effort to obtain further resolution of its asbestos liability. These discussions have encompassed the possibility of global as well as individual law firm settlements.

"These meetings are by mutual consent," stated Hiner. "The discussions will continue and we expect to know by year end whether we can achieve further agreement. Plaintiff attorneys involved in the talks stated they will not serve any more non-malignancy claims on Owens Corning while negotiations continue."

In reference to the dividend, Hiner stated, "we were able to initiate this action because debt has been reduced to target levels and cash flow from operations will be in excess of internal funding requirements."

"We are delighted to be able to reward our shareholders with a dividend," said Hiner. "Reinstating the dividend has been a priority of mine since joining the company and I am pleased that we now are in a position to set the date."

The Toledo-based company had 1995 sales of $3.6 billion and employs 18,000 people in more than 30 countries.

April 29, 1998

Owens Corning opened a new front in its battle to avoid being swamped by tens of thousands of damage claims filed by people who say they got sick from exposure to asbestos-containing insulation produced by the company. Owens Corning charged in U.S. District Court in Toledo, Ohio, that Allstate Insurance Co. is guilty of breach of contract by failing to provide coverage.

Owens Corning announced in March 1998 that it might have to spend more than expected to resolve asbestos claims because of growing damage awards to people with a severe form of asbestos-linked cancer called mesothelioma.

Required

a. In the long run, cash receipts from operations is equal to revenue from operations. Comment.

b. February 6, 1992-Owens Corning announced a special noncash charge of $800 million to accrue for the estimated uninsured cost of future asbestos claims the company may receive through the balance of the decade. How much will the noncash charge reduce gross earnings in 1992? Over what period of time is the expected outflow?

c. June 20, 1996-Owens Corning announced a net, after-tax charge of $545 million for asbestos claims received after 1999. How much will this charge reduce net income in 1996? Over what period of time is the cash outflow expected?

d. Assume Owens Corning receives money related to the federal lawsuit alleging falsified medical tests. In what period will the cash inflow be recorded? When will the related revenue be recorded?

e. April 29, 1998-Owens Corning filed suit against Allstate Insurance Co. related to asbestos exposure coverage. What are the apparent implications if Owens Corning does not win the suit?

f. Owens Corning announced in March 1998 that it might have to spend more than expected to resolve asbestos claims. What does this imply as to future expenses and cash outflow related to asbestos claims?

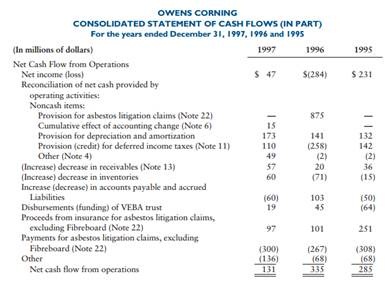

g. Owens Corning, consolidated statement of cash flows, for the years ended December 31, 1997, 1996, and 1995.

1. What year has a charge for asbestos litigation claims?

2. What years have cash inflow from proceeds from insurance for asbestos litigation claims?

3. What years have payments for asbestos litigation claims?