Reference no: EM131008747

FINANCE

1. The Hasting Company began operations on January 1, 2003 and uses the FIFO method in costing its raw material inventory. An analyst is wondering what net income would have been if the company had consistently followed LIFO (instead of FIFO) from the beginning, 1/1/2003. He has the following information available to him:

What would net income have been in 2004 if Hastings had used LIFO since 1/1/2003?

$ 110,000

$ 150,000

$ 170,000

$ 230,000

|

|

12/31/2003

|

12/31/2004

|

|

Final Inventory

|

|

|

|

Under FIFO

|

$ 240,000

|

$ 270,000

|

|

Under LIFO

|

$ 200,000

|

$ 210,000

|

|

|

For 2003

|

For 2004

|

|

Pretax Income under FIFO

|

$ 120,000

|

$ 170,000

|

2. A customer is currently suing a company. A reasonable estimate can be made of the costs that would result from a ruling unfavorable to the company, and the amount involved is material. The company's managers, lawyers, and auditors agree that there is only a remote likelihood of an unfavorable ruling. This contingency:

Should be disclosed in a footnote.

Should be disclosed as a parenthetical comment in the balance sheet.

Need not to be disclosed.

Should be disclosed by an appropriation of retained earnings.

3. The ABC Company operates a catering service specializing in business luncheons for large corporations. ABC requires customers to place their orders 2 weeks in advance of the scheduled events. ABC bills its customers on the tenth day of the month following the date of service and requires that payment be made within 30 days of the billing date. Collections from customers have never been an issue in the past. ABC should recognize revenue from its catering services at the date when a:

Customer places an order.

Luncheon is served.

Billing is mailed.

Customer's payment is received.

4. On June 30, 2001, Cole Inc., exchanged 3,000 shares of Stone Corp. $30 par value common stock for a patent owned by Gore Co.. The Stone stock was acquired in 1999 at a cost of $80,000. At the exchange date, Stone common stock had a fair value of $45 per share, and the patent had a net carrying value of $160,000 on Gore's books. Cole should record the patent at:

$80,000

$90,000

$135,000

$160,000

5. On June 30, 2001, Cole Inc., exchanged 3,000 shares of Stone Corp. $30 par value common stock for a patent owned by Gore Co.. The Stone stock was acquired in 1999 at a cost of $80,000. At the exchange date, Stone common stock had a fair value of $45 per share, and the patent had a net carrying value of $160,000 on Gore's books. Cole should record the patent at:

$80,000

$90,000

$135,000

$160,000

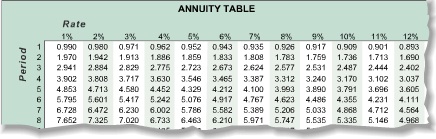

6. On January 1, 1997, Phillips, Inc. leased a new machine from U.S. Leasing. The specific information on the lease is as follows:

|

Lease inception

|

January 1, 1997

|

|

Annual rental payment at December 31 of each year

|

$ 51,352

|

|

Economic life of the machine

|

8 years

|

|

Market value of the machine

|

$ 275,000

|

|

Interest rate used by Phillips, Inc.

|

10%

|

|

End of 7 - year lease term

|

December 31, 2003

|

On January 1, 1997, Phillips, Inc. should record a lease liability of:

$275,000

$359,464

$0

$250,000

7. FRC Inc. acquired Marketing Inc on 1/1/2004. Marketing Inc. has 10,000 shares outstanding. Each share in Marketing Inc. was exchanged for half a share in FRC, Inc. Shares of FRC Inc., were trading at $100 per share at the date of the announcement of the transaction. Marketing Inc, had the following assets and liabilities that were assumed by FRC Inc.

|

Assets and Liabilities

|

Book Value prior to acquisition

|

Market Value on acquisition date

|

|

Cash

|

$ 10,000

|

$ 10,000

|

|

Accounts Receivables

|

$ 5,000

|

$ 5,000

|

|

Equipment

|

$ 10,000

|

$ 5,000

|

|

Patent

|

$ 0

|

$100,000

|

|

Short Term Debt

|

$ 20,000

|

$ 20,000

|

The amount of Goodwill recognized by FRC, Inc. on January 1, 2004 is:

$400,000

$360,000

$495,000

$455,000

8. ABC expenses stock options as required by GAAP. On January 1,2005, ABC granted 50 key executives 100 options each. Each option entitled the option holder to purchase 1 share of ABC common stock at $60 per share. The options will vest on January 1st 2008.

On the grant date, January 1st, 2005, the stock was quoted on the stock exchange at $63 per share. The fair value of the options on the grant date was estimated at $15 per option. The amounts of compensation expense ABC should recognize with respect to the options during 2005, 2006, and 2007 are:

|

|

2005

|

2006

|

2007

|

|

1.

|

$ 5.000

|

$ 5.000

|

$ 5.000

|

|

2.

|

50

|

$ 0

|

$ 15.000

|

|

3.

|

$ 25.000

|

$ 25.000

|

$ 25.000

|

|

4.

|

S0

|

$ 0

|

$75.000

|

9. Which of the following situations will not cause a deferred income tax amount to be recorded?

An expense that is recognized in 2005 for income tax purposes and in 2006 for financial statement purposes.

Interest income from municipal bonds that is recognized in 2005 for financial statement purposes but is tax exempt for income tax purposes.

A revenue is recognized in 2005 for income tax purposes and in 2006 for financial statement purposes.

None of the above situations would cause a deferred income tax amount.

10. In periods with rising prices and increasing quantities of inventories, which of the following relationships among inventory valuation methods is generally correct:

FIFO has a higher inventory balance and a lower net income than LIFO.

FIFO has a higher inventory balance and a higher net income than LIFO.

LIFO has a higher inventory balance and a higher net income than FIFO.

LIFO has a higher inventory balance and a lower net income than FIFO.

11. Denny Co. sells major household appliance service contracts for cash. The service contracts are for a one-year, two-year, or three-year period. Cash receipts from contracts are credited to Unearned Service Revenues. This account had a balance of $900,000 at December 31, 2001 before year-end adjustment. Service contracts still outstanding at December 31, 2001 expire as follows:

|

Service contracts still outstanding at December 31, 2001 expire as follows:

During 2002 5190,000

During 2003 5285,000

During 2004 5125,000

|

What amount should be reported as Unearned Service Revenues in Denny's December 31, 2001 balance sheet?

$900,000

$600,000

$1,500,000

$300,000

12. ABC signed a 5-year operating lease agreement whereby WXY Rentals will provide a truck which cost WXY $20,000. The lease payments are $2,500, payable at the end of each year. The truck will revert to WXY at the end of five years. The truck has a 10-year useful life. At the inception of the lease, ABC should:

make no journal entry

record rental expense of $2,500 for the first year's rental

record the lease asset and a corresponding liability, at its current market value

record the lease asset and a corresponding liability, at the present value of the five equal annual lease payments.

13. Merry Co. purchased a machine costing $125,000 for its manufacturing operations and paid shipping costs of $20,000. Merry spent an additional $10,000 testing and preparing the machine for use. What amount should Merry record as the cost of the machine?

$155,000

$145,000

$135,000

$125,000

14. Ignoring any related tax implications, what is the effect on a company's balance sheet when depreciation expense is recognized?

This transaction affects only the income statement, so no change on the balance sheet will occur.

Total assets and total stockholder's equity will decrease by the same amount.

There will be no change in the total assets, liabilities and stockholders equity accounts.

Total liabilities will increase and total stockholder's equity will decrease by the same amount.

15. The Hastco Company had the following balances in their stockholders' equity accounts as of December 31, 2000:

Paid-in Capital: $53,000

Retained Earnings: $31,000

During the year ended December 31, 2000, The Hastco Company generated $36,000 in net income, and declared and paid $16,000 in Dividends. The ending balance in the retained earnings account at December 31, 1999 was:

$11,000

$37,000

$5,000

$61,000

16. All of the following would qualify a lease as a capital lease except:

The lease term is 80% of the asset's estimated useful life.

The lease agreement contains a bargain purchase option.

The present value of the lease payments equals 70% of the fair market value of the leased asset.

Title to the leased asset transfers to the lessee at the end of the lease term.

17. Which of the following is/are criteria for recognizing revenue from a sale?

Title and risks of ownership have been exchanged.

The company is reasonably assured of collecting the receivable.

The customer has, in turn, sold the product to its own customer.

Both title and risks of ownership have been exchanged and the company is reasonably assured of collecting the receivable.

18. Use the following information to answer the next two questions.

Downey Company bought a delivery truck for $62,000 on January 1, 2005. They installed a rear hydraulic lift for $8,000 and paid sales tax of $3,000. In addition, Downey paid $2,400 for a one-year insurance policy. They estimate the useful life of the truck to be 10 years and its residual value to be $8,000.

If Downey uses the straight-line method of depreciation, what is the depreciation expense for 2006 and book value at the end of 2006?

$7,300 and $58,400

$6,500 and $60,000

$6,790 and $62,320

$6,500 and $66,500

19. Downey Company bought a delivery truck for $62,000 on January 1, 2005. They installed a rear hydraulic lift for $8,000 and paid sales tax of $3,000. In addition, Downey paid $2,400 for a one-year insurance policy. They estimate the useful life of the truck to be 10 years and its residual value to be $8,000.

If Downey uses the double declining-balance method, how much is the truck's depreciation expense for2006?

$11,680

$12,144

$10,400

$11,760

20. For accounting purposes, goodwill

is recorded whenever a company achieves a level of net income that exceeds the industry average.

is recorded when a company purchases another business.

is expensed in the period it is recorded because benefits from goodwill are difficult to identify.

is never recorded

21. Goodwill should

be written off as soon as possible against retained earnings.

absent impairment, not be written off because it has an indefinite life.

written off as soon as possible as an expense.

amortized over a maximum of forty years.

22. Freeman, Inc., reported net income of $40,000 for 2005. However, the company's income tax return excluded a revenue item of $3,000 (reported on the income statement) because under the tax laws the $3,000 would not be reported for tax purposes until 2006. Assuming a 30% income tax rate, this situation would cause a 2005 deferred tax amount of

$3,000 asset.

$3,000 liability

$ 900 asset.

$ 900 liability.

23. Before closing entries were recorded at the end of the accounting period (December 31, 2005), the following data were taken from the accounts of Buynow Corporation:

| Capital Stock, par $10 (20,000 shares issued) |

$200,000 |

| Contributed capital in excess of par |

15,000 |

| Retained earnings, balance December 31, 2004 |

80,000 |

| Revenues earned during 2005 |

400,000 |

| Expenses incurred during 2005 |

344,000 |

| Cash dividends declared and paid (during 2005) |

30,000 |

| Treasury stock (1,000 shares at cost) |

17,000 |

The total amount of owners' equity that should be reported on the balance sheet dated December 31, 2005, after all the closing entries, is

$ 338,000.

$128,000.

$300,000.

$304,000.

24. The major accounting difference between interest incurred during a period and cash dividends declared during the same period is:

Interest decreases retained earnings while dividend declared increases retained earnings

Interest reduces net income while dividends declared do not affect net income

Interest does not affect net income while dividends reduce net income

There is no major difference. Both are treated identically for accounting purposes.

25. In December, a Global Grocer customer pays in time and receives a 2% discounts for prompt payment. The customer had purchased goods worth $500. Which of the possible answers below correctly states the journal entries to record the payment and the discount taken. Previously, Global Grocer had established an allowance for prompt payment discounts.

Debit Accounts receivable ($500); Credit Cash ($490); credit allowance for discounts ($10).

Debit Cash ($500); Credit Accounts receivable ($500).

Debit Cash ($490); Debit Allowance for sales discounts ($10); Credit Accounts receivable ($500)

None of the above

26. Here is International Corp.'s income statement for the month of December.

What is the company's December EBITDA to total interest coverage ratio?

6.5x

18.5x

14.5x

20.2x

27. The following financial ratios are for Average Corp. and Superior Corp., two hardware stores.

Which of the following statements is inconsistent with the above ratios?

Superior Corp has a higher return on equity primarily because it has a significantly higher net income margin

Average Corp. on a relative basis uses significantly more debt financing than Superior Corp.

Average Corp. utilizes its assets more effectively than Superior Corp.

Superior Corp. generates more income per dollar of sales than Average Corp.

28.On June 30, 2000, Microsoft Corporation was holding $4.8 billion of cash that it had collected from customers in advance for future software licenses and the future delivery of other products and services. In its financial statements, Microsoft classified and recorded this amount as:

part of revenue on its income statement.

the asset Accounts Receivable on its balance sheet.

the liability Unearned Revenue on its balance sheet.

an expense on its income statement.

29. Which statement is false?

An unrealized gain or loss on hold-to-maturity marketable securities is recognized in income.

An unrealized gain or loss on trading securities is recognized in income.

An unrealized gain or loss on a company's common stock held by the owners' of the company is not recognized by the company.

An unrealized gain or loss on available-for-sale marketable securities is not recognized in income.

30. International, Inc. established an allowance for bad debts at the end of October. In November, International wrote off a $500 account receivable because payment was considered to be remote. What would be the effect of the $500 account receivable write-off on International's November financial statements?

Assets would decrease, liabilities would remain constant and retained earning would decrease.

Assets would remain constant; liabilities would increase and retained earnings would decrease.

No change would be made in total assets, liabilities or shareholder's equity.

Assets would decrease, liabilities would decrease and retained earnings would remain constant.