Reference no: EM131100010

Questions

1. What is your name?

1. You are given the following information about the quantity that a monopolistic competitor is producing and selling, its price, average total cost, marginal cost, and marginal revenue.

Q= quantity; P = price; ATC = average total cost, MC = marginal costs, MR = marginal revenue

|

Q

|

P

|

ATC

|

MC

|

MR

|

|

100

|

50

|

30

|

20

|

25

|

a. Is the firm maximizing profit?

i. Yes

ii. No

b. Answer this question if your answer to a is "No". Skip it if your answer is "Yes".

What would increase profit?

i. An increase in output

ii. A decrease in output

c. Answer this question if your answer to a is "Yes". Skip it if your answer is "No".

Is the firm in a long-run equilibrium?

i. Yes

ii. No

d. Answer this question if your answer to c is "No". Skip it if your answer is "Yes".

What would happen in the long run?

i. Entry would occur

ii. Exit would occur

1. You are given the following information about the quantity that a monopolistic competitor is producing and selling, its price, average total cost, marginal cost, and marginal revenue.

Q= quantity; P = price; ATC = average total cost, MC = marginal costs, MR = marginal revenue

|

Q

|

P

|

ATC

|

MC

|

MR

|

|

100

|

50

|

30

|

20

|

20

|

a. Is the firm maximizing profit?

i. Yes

ii. No

b. Answer this question if your answer to a is "No". Skip it if your answer is "Yes".

What would increase profit?

i. An increase in output

ii. A decrease in output

c. Answer this question if your answer to a is "Yes". Skip it if your answer is "No".

Is the firm in a long-run equilibrium?

i. Yes

ii. No

d. Answer this question if your answer to c is "No". Skip it if your answer is "Yes".

What would happen in the long run?

i. Entry would occur

ii. Exit would occur

1. You are given the following information about the quantity that a monopolistic competitor is producing and selling, its price, average total cost, marginal cost, and marginal revenue.

Q= quantity; P = price; ATC = average total cost, MC = marginal costs, MR = marginal revenue

|

Q

|

P

|

ATC

|

MC

|

MR

|

|

100

|

50

|

30

|

30

|

20

|

a. Is the firm maximizing profit?

i. Yes

ii. No

b. Answer this question if your answer to a is "No". Skip it if your answer is "Yes".

What would increase profit?

i. An increase in output

ii. A decrease in output

c. Answer this question if your answer to a is "Yes". Skip it if your answer is "No".

Is the firm in a long-run equilibrium?

i. Yes

ii. No

d. Answer this question if your answer to c is "No". Skip it if your answer is "Yes".

What would happen in the long run?

i. Entry would occur

ii. Exit would occur

1. You are given the following information about the quantity that a monopolistic competitor is producing and selling, its price, average total cost, marginal cost, and marginal revenue.

Q= quantity; P = price; ATC = average total cost, MC = marginal costs, MR = marginal revenue

|

Q

|

P

|

ATC

|

MC

|

MR

|

|

100

|

50

|

50

|

50

|

25

|

a. Is the firm maximizing profit?

i. Yes

ii. No

b. Answer this question if your answer to a is "No". Skip it if your answer is "Yes".

What would increase profit?

i. An increase in output

ii. A decrease in output

c. Answer this question if your answer to a is "Yes". Skip it if your answer is "No".

Is the firm in a long-run equilibrium?

i. Yes

ii. No

d. Answer this question if your answer to c is "No". Skip it if your answer is "Yes".

What would happen in the long run?

i. Entry would occur

ii. Exit would occur

1. You are given the following information about the quantity that a monopolistic competitor is producing and selling, its price, average total cost, marginal cost, and marginal revenue.

Q= quantity; P = price; ATC = average total cost, MC = marginal costs, MR = marginal revenue

|

Q

|

P

|

ATC

|

MC

|

MR

|

|

100

|

50

|

50

|

25

|

25

|

a. Is the firm maximizing profit?

i. Yes

ii. No

b. Answer this question if your answer to a is "No". Skip it if your answer is "Yes".

What would increase profit?

i. An increase in output

ii. A decrease in output

c. Answer this question if your answer to a is "Yes". Skip it if your answer is "No".

Is the firm in a long-run equilibrium?

i. Yes

ii. No

d. Answer this question if your answer to c is "No". Skip it if your answer is "Yes".

What would happen in the long run?

i. Entry would occur

ii. Exit would occur

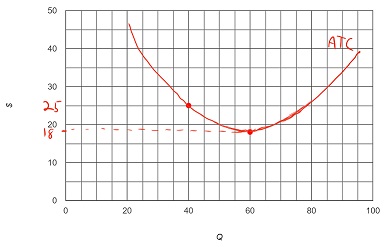

1. A monopolistically competitive restaurant in long-run equilibrium is maximizing profit by producing and selling 50 meals a day. It minimizes average total cost by producing and selling 60 meals per day. The following table contains information about average total cost and marginal cost at these two quantities.

a. The graph below contains a sketch of the average total cost curve. Add to this graph a sketch of the demand, marginal revenue, and marginal cost curves facing the firm.

b. What is the socially efficient quantity? The socially efficient quantity is

i. less than 40

ii. 40

iii. between 40 and 60

iv. 60

v. greater than 60

c. Shade the area that represents the deadweight loss.

d. Suppose that the industry changed from monopolistically competitive to perfectly competitive. In the long run price would be

i. greater than 25

ii. 25

iii. between 18 and 25

iV. 18

v. less than 18

Part II

Use the information below to answer the remaining questions.

HH Gregg and Best Buy are the only two firms that sell a large screen TV in a town. Communication to coordinate pricing is illegal but the two firms have figured out a way to communicate with each other without detection by law enforcement officers. Suppose that they communicate and both agree to set the same price. L22-GA, Profits contain two profit tables. The first shows the profits earned by HH Gregg for every possible combination of prices. The second table shows the profits earned by Best Buy. The tables are symmetric.

|

Profit earned by HH Gregg

|

|

|

Price charged by Best Buy

|

|

|

10

|

11

|

12

|

13

|

14

|

15

|

16

|

17

|

18

|

19

|

20

|

|

Price charged by HH Gregg

|

10

|

300

|

300

|

400

|

450

|

700

|

650

|

800

|

700

|

700

|

500

|

300

|

|

11

|

350

|

400

|

450

|

500

|

800

|

700

|

850

|

800

|

800

|

600

|

400

|

|

12

|

325

|

425

|

500

|

550

|

900

|

800

|

900

|

900

|

900

|

700

|

500

|

|

13

|

300

|

400

|

525

|

600

|

800

|

850

|

950

|

1000

|

1000

|

800

|

600

|

|

14

|

275

|

375

|

500

|

575

|

700

|

900

|

1000

|

1100

|

1100

|

900

|

700

|

|

15

|

250

|

350

|

475

|

550

|

675

|

800

|

950

|

1200

|

1200

|

1000

|

800

|

|

16

|

225

|

325

|

450

|

525

|

650

|

775

|

900

|

1100

|

1300

|

1100

|

900

|

|

17

|

200

|

300

|

425

|

500

|

625

|

750

|

875

|

1000

|

1200

|

1200

|

1000

|

|

18

|

175

|

275

|

400

|

475

|

600

|

725

|

850

|

975

|

1100

|

1100

|

1100

|

|

19

|

150

|

250

|

375

|

450

|

575

|

700

|

825

|

950

|

1075

|

1000

|

1000

|

|

20

|

125

|

225

|

350

|

425

|

550

|

675

|

800

|

925

|

1050

|

975

|

900

|

|

Profit earned by Best Buy

|

|

|

Price charged by HH Gregg

|

|

|

10

|

11

|

12

|

13

|

14

|

15

|

16

|

17

|

18

|

19

|

20

|

|

Price charged by Best Buy

|

10

|

300

|

300

|

400

|

450

|

700

|

650

|

800

|

700

|

700

|

500

|

300

|

|

11

|

350

|

400

|

450

|

500

|

800

|

700

|

850

|

800

|

800

|

600

|

400

|

|

12

|

325

|

425

|

500

|

550

|

900

|

800

|

900

|

900

|

900

|

700

|

500

|

|

13

|

300

|

400

|

525

|

600

|

800

|

850

|

950

|

1000

|

1000

|

800

|

600

|

|

14

|

275

|

375

|

500

|

575

|

700

|

900

|

1000

|

1100

|

1100

|

900

|

700

|

|

15

|

250

|

350

|

475

|

550

|

675

|

800

|

950

|

1200

|

1200

|

1000

|

800

|

|

16

|

225

|

325

|

450

|

525

|

650

|

775

|

900

|

1100

|

1300

|

1100

|

900

|

|

17

|

200

|

300

|

425

|

500

|

625

|

750

|

875

|

1000

|

1200

|

1200

|

1000

|

|

18

|

175

|

275

|

400

|

475

|

600

|

725

|

850

|

975

|

1100

|

1100

|

1100

|

|

19

|

150

|

250

|

375

|

450

|

575

|

700

|

825

|

950

|

1075

|

1000

|

1000

|

|

20

|

125

|

225

|

350

|

425

|

550

|

675

|

800

|

925

|

1050

|

975

|

900

|

1. What price maximizes the sum of their profits?

2. How much profit does each firm earn when they charge the same price and maximize the sum of their profits?

3. What price maximizes profit for HH Gregg when Best Buy's price = a?

4. What price do the firms charge in the Nash equilibrium? (Since the profit tables are symmetric, each firm will charge the same price in the Nash equilibrium.)

5. How much profit does each firm earn in the Nash equilibrium?

6. If the marginal cost of the large screen TV is 400, what price would the firms charge in a competitive market?

7. How much profit does each firm earn in a competitive market?