Reference no: EM13495573

Consider a two-date binomial model. A company has both debt and equity in its capital structure. The value of the company is 100 at Date 0. At Date 1, it is equally like that the value of the company increases by 20% or decreases by 10%. The total promised amount to the debtholders is 100 at Date 1. The riskfree interest rate is 10%.

(a) What are the possible payoffs to the equityholders at date 1? What kind of financial product has the same payoffs? Please describe the detailed characteristics of the financial product.

(b) What are the possible payoffs to the bondholders at date 1? Are they riskfree? What kind of financial product/portfolio has the same payoffs? Please describe the detailed characteristics of the financial product/portfolio.

(c) What is the value of the debt at Date 0? What is the value of the equity at Date 0?

(d) Suppose the government announces that it guarantees the company's payment to the debtholders. How much is the government guarantee worth?

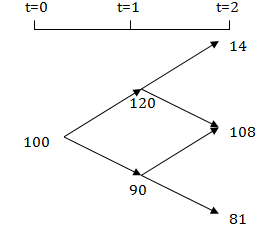

(e) Now we extend the model to a three-date setting. At both Date 1 and Date 2, it is equally likely that the value of the company increases by 20% or decreases by 10%, as depicted in the graph below. Suppose there is an American put option written on the entire firm with strike price 100. What is the value of this American put at Date 0?

Value of the firm in a three-date setting.

Note: This applies to part (e) only.