Reference no: EM131110418

(Balance Sheet and Income Statement Disclosure-Lessee) The following facts pertain to a non-cancelable lease agreement between Alschuler Leasing Company and McKee Electronics, a lessee, for a computer system.

Inception date October 1, 2010

Lease term 6 years

Economic life of leased equipment 6 years

Fair value of asset at October 1, 2010 $300,383

Residual value at end of lease term -0-

Lessors implicit rate 10%

Lessee's incremental borrowing rate 10%

Annual lease payment due at the beginning ofeach year, beginning with October 1, 2010 $62,700

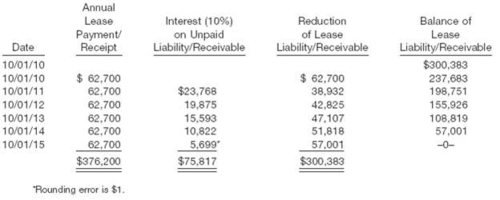

The Collectibility of the lease payments is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor. The lessee assumes responsibility for all executory costs, which amount to $5,500 per year and are to be paid each October 1, beginning October 1, 2010. (This $5,500 is not included in the rental payment of $62,700.) The asset will revert to the lessor at the end of the lease term. The straight-line depreciation method is used for all equipment. The following amortization schedule has been prepared correctly for use by both the lessor and the lessee in accounting for this lease. The lease is to be accounted for properly as a capital lease by the lessee and as a direct-financing lease by the lessor.(Round all numbers to the nearest cent.)

(a) Assuming the lessee's accounting period ends on September 30, answer the following questions with respect to this lease agreement.

(1) What items and amounts will appear on the lessee's income statement for the year ending September 30, 2011?

(2) What items and amounts will appear on the lessee's balance sheet at September 30, 2011?

(3) What items and amounts will appear on the lessee's income statement for the year ending September 30, 2012?

(4) What items and amounts will appear on the lessee's balance sheet at September 30, 2012?

(b) Assuming the lessee's accounting period ends on December 31, answer the following questions with respect to this lease agreement.

(1) What items and amounts will appear on the lessee's income statement for the year ending December 31, 2010?

(2) What items and amounts will appear on the lessee's balance sheet at December 31, 2010?

(3) What items and amounts will appear on the lessee's income statement for the year ending December 31, 2011?

(4) What items and amounts will appear on the lessee's balance sheet at December 31,2011?

|

Select one of the models ranging from naylor

: Select one of the models ranging from Naylor (1967) and the Preparation-Engagement-Perpetuation (PEP) model listed from Chapter 1 of the Connors (2012) text and compare and contrast them in regards to what makes them similar and dissimilar.

|

|

Nutritional etiology of wernicke-korsakoff syndrome

: Nutritional Etiology of Wernicke-Korsakoff Syndrome - research report and The two conditions present neuropathological symptoms, hence the combination.

|

|

Philosophy of education discussion

: Prepare:Read the articles "Philosophy as Translation: Democracy and Education from Dewey to Cavell" and "Philosophy as Education and Education as Philosophy: Democracy and Education from Dewey to Cavell"by Saitofrom the EBSCOhost database in the A..

|

|

Does it make economic sense for the smiths to hire

: The Smiths have calculated that total additional expenses such as child care, clothing, personal expenses, meals away from home, and transportation related to Maggie's job could total $1,400 per month.Does it make economic sense for the Smiths to hir..

|

|

What items and amounts will appear on the lessee

: Assuming the lessee's accounting period ends on September 30, answer the following questions with respect to this lease agreement.

|

|

Determine the curvature term that arises from the noise

: Assume that π(v) is a smooth function of the noise v in the model of Fig. 9.6. Using a Taylor expansion of the distortion measure of Eq. (9.19), determine the curvature term that arises from the noise model π(v)

|

|

Decades and continues to implement strategies

: Wilson has been producing tennis racquets for many decades and continues to implement strategies that make it a leader in the tennis racquet industry. Suppose that when wilson and its largest rival, Head advertise, each company earns $0 billion in pr..

|

|

Would you recommend the merger

: Would you recommend the merger? Would you recommend the merger if Dodd could use the $125,000 to purchase equipment that will return cash inflows of $40,000 per year for each of the next 10 years? If the cost of capital did not change with the merger..

|

|

Find a property on the permutations

: Find a set of coset representatives of S3 in S4 (i.e., one from each coset). Find a property on the permutations of S4 such that σ and τ share this property if and only if they are in the same coset

|