Reference no: EM131912905

Assignment

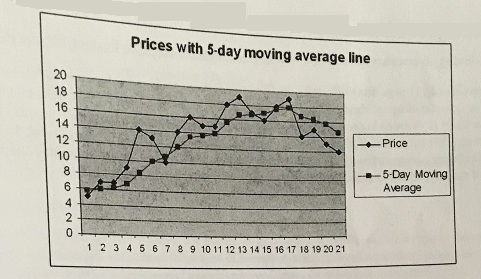

1. Identify the sell signals in the chart by comparing price with its 5 moving average day Prices with 5-day moving average line

2. Consider two bonds, A and B. Both bonds presently are selling at their par value of Each pays interest of $120 annually. Bond A will mature in 5 while bond B will years, mature change in the two bonds if the yields to maturity on the in 6 years. Calculate the price two bonds change from 12% to 14%

3. A convertible bond has a par value of $1,000, but its current market price is $975. The current price of the issuing company's stock is $26, and the conversion ratio is 34 shares. What is the bond's market conversion value?

4. A callable bond pays annual interest of $60, has a par value of $1,000, matures in 20 years but is callable in 10 years at a price of $1,100, and has a value today of $1055.84. What is the yield to call on this bond?

5. A coupon bond that pays semiannual interest is reported in the Wall Street Journal as having an ask price of 117% of its $1,000 par value. If the last interest payment was made 2 months ago and the coupon rate is 6%, what is the price of the bond?

6. A Treasury bond due in year has a yield of 6.3%, while a Treasury bond due in 5 1 years has a yield of 8.8%. A bond due 5 years issued by High Country Marketing Corp. has of in yield of 9.6%, while a bond due in 1 year issued by High Country Marketing Corp. has a yield What are the default risk premiums on the 1-year and 5 year bonds issued by High Country Marketing Corp

7. You purchased a 5-year annual interest coupon bond 1 year ago. Its coupon interest rate was 6%, and its par value was $1,000. At the time you purchased the bond, the yield to maturity was 4%. What is your annual total rate of return on holding the bond for that year if you sold the bond after receiving the first interest payment and the bond's yield to maturity changed to 3%

8. points) A bond has a par value of a time to maturity of 10 years, and a coupon rate of $1,000, 8% with interest paid annually. If the current market price is $750, what is the capital gain yield f this bond over the next year ?