Reference no: EM133028141

Assignment - Risk and Return

Essay Questions

Question 1. Define risk and it related to financial decision making. Why is it important for a decision maker to have some sense of the risk or uncertainty associated with an investment in an asset? Do any assets have perfectly certain returns?

Question 2. Describe the basic calculation involved in finding the return on an investment. Di?erentiate between realized and unrealized returns.

Question 3. Compare and contract the following risk preference behaviors, and indicate which is most commonly exhibited by the financial manager: a. Risk-averse, b. Risk-indi?erent, and c. Risk- seeking.

Question 4. What does the standard deviation of a distribution of asset returns indicate? What relationship exists between the rise of standard deviation and the degree of asset risk?

Question 5. Why must assets be evaluated in a portfolio context? What is an e?cient portfolio? How can the return and standard deviation of a portfolio be determined?

Question 6. What is measured by beta? Define beta. How are assets betas derived, and where can they be obtained? (Explain using CAPM)

Calculation Questions

Question 1. Betas and Risk Rankings: Stock A has a beta of 0.80, stock B has beta of 1.40, and stock C has a beta of -0.30.

A. Rank these stocks from the most risky to the least risky.

B. If the return on the market portfolio increases by 12 percent, what change would you expect in the return for each of the stocks?

C. If the return on the market portfolio declines by 5 percent, what change would you expect in the return for each of the stocks?

D. If you felt that the stock market was just ready to experience a significant decline, which stock would you likely add to your portfolio? Why?

E. If you anticipated a major stock market rally, which stock would you add to your portfolio? Why?

Question 2. Capital asset pricing model (CAPM): For each of the cases in the following table, use the capital asset pricing model to find the required return.

|

Case

|

Risk-free rate, (%)

|

Market return, (%)

|

Beta

|

|

A

|

5

|

8

|

1.30

|

|

B

|

8

|

13

|

.90

|

|

C

|

9

|

12

|

-.20

|

|

D

|

10

|

15

|

1.00

|

|

E

|

6

|

-10

|

.60

|

Question 3. Manipulating CAPM: Using the basic equation for the capital asset pricing model (CAPM) to work each of the following:

A. Find the required return for an asset with a beta of .90 when the risk0free rate and market return are 8 and 12 percent, respectively.

B. Find the risk-free rate for a firm with a required return of 15% and a beta of 1.25 when the market return is 14%.

C. Find the market return for an asset with a required return of 16% and a beta of 1.10 when the risk-free rate is 9%.

D. Find the beta for an asset with a required return of 15% when the risk-free rate and market return are 10 and 12.5%, respectively.

Question 4. Analyzing Risk and Return on Chargers Products' Investments

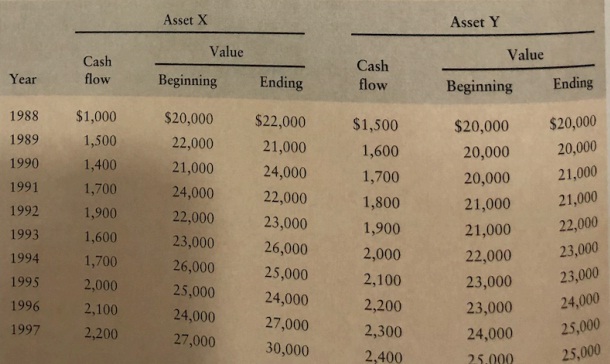

Junior Sayou, a financial analyst for Chargers Products, a manufacturer of stadium benches, must evaluate the risk and return of two assets-X and Y. The firm is considering adding these assets to its diversified asset portfolio. To assess the return and risk of each asset, Junior gathered data on the annual cash flow and beginning- and end-of-year values of each asset over the immediately preceding 10 years, 1988-1997. These data are summarized in the following table. Junior's to perform investigation suggests that both assets, on average, will tend to perform in the future just as they have during the past 10 years. He therefore believes that the expected annual return can be estimated by finding the average annual return for each asset over the past 10 years.

Junior believes that each asset's risk can be assessed in two ways: in isolation and as part of the firm's diversified portfolio of assets. The risk of the assets in isolation can be found by using the standard deviation and coefficient of variation of returns over the past 10 years.

The capital asset pricing model (CAPM) can be used to assess the asset's risk as part of the firm's portfolio of assets. Applying some sophisticated quantitative techniques, Junior estimated betas for assets X and Y of 1.60 and 1.10, respectively. In addition, he found that the risk-free rate is currently 7 percent and the market return is 10 per¬cent.

Return Data for Assets X and Y, 1988-1997

Required

a. Calculate the annual rate of return for each asset in each of the 10 preceding years, and use those values to find the average annual return for each asset over the 10-year period.

b. Use the returns calculated in a to find (1) the standard deviation and (2) the coefficient of variation of the returns for each asset over the 10-year period 1988-1997.

c. Use your findings in a and b to evaluate and discuss the return and risk associated with each asset. Which asset appears to be preferable? Explain.

d. Use the CAPM to find the required return for each asset. Compare this value with the average annual returns calculated in a.

e. Compare and contrast your findings in c and d. What recommendations would you give Junior with regard to investing in either of the two assets?

Explain to Junior why he is better off using beta rather than the standard deviation and coefficient of variation to assess the risk of each asset.

f. Rework d and e under each of the following circumstances:

(1) A rise of 1 percent in inflationary expectations causes the risk-free rate to rise to 8 percent and the market return to rise to 11 percent.

(2) As a result of favorable political events, investors suddenly become less risk-averse, causing the market return to drop by 1 percent to 9 percent.

Question 5. Creating Own Portfolio: Choose any two publicly listed company on Indonesian Stock Exchange (ie., BBCA - stock of Bank BCA). Download the historical stock returns (annual) of the chosen stock for 10 years (2011 ~ 2020) in Excel format. Using the stock return data of the two stocks, Calculate the following :

A. Average return for 10 years for both stocks

B. Assume the first stock is .30 weight, second stock is .70 weight in the portfolio. What is the expected return of the portfolio.

C. What is the variance and standard deviation of both stocks.

D. What is the variance of the portfolio. (The variance of individual stocks and the covariance between the two stocks)

E. Find the inflation rate from the Bank Indonesia website for year 2020 (for Risk-free rate). Find the annual stock return of the Jakarta Stock Exchange (^JKSE) for year 2020. Find the Beta for both stocks using the CAPM formula.