Reference no: EM131472396 , Length: 6

Question 1. There are two countries in the world, Yego and Zed. Currently, Yego and Zed do not permit international capital flows. Yego has $5 trillion of capital; KYEGO = 5. Zed also has $5 trillion dollars of capital, KZED =5. The marginal product of capital schedules are known to be:

MPKYEGO = 36 - 5KYEGO

MPKZED = 22 - 4KZED

The marginal products of capital are quoted as real rates of return (real interest rates).

A. Is this equal split of capital between Yego and Zed (KYEGO = 5 and KZED = 5) optimal? Explain your position carefully.

B. Suppose Yego and Zed begin to allow free flows of capital.

Will Yego borrow or lend capital, and how much will it borrow or lend?

Will Zed borrow or lend capital, and how much will it borrow or lend?

After international capital flows, what is the world equilibrium real interest rate?

After international capital flows, how much is Yego better off or worse off?

After international capital flows, how much is Zed better off or worse off?

After international capital flows, how much is the world better off or worse off?

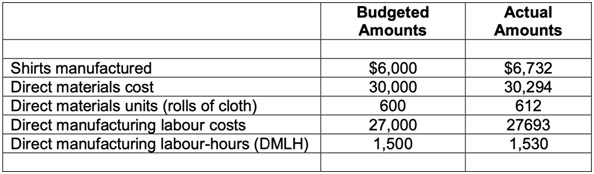

Question 2. Suppose the U.S. and South Africa currently do not allow capital flows between the two countries, but that they are negotiating a bilateral agreement to permit up to $2 trillion of capital flows. This would be a capital, control - the countries are not permitting free flows ot capital and are regulating the quantity of foreign investment. Currently, the U.S. has $14 trillion of capital and South Africa has $6 trillion. The diagram below shows the MPK schedules for the U.S. and South Africa. The MPK schedules for the U.S. and South Africa are:

MPKU.S. = 17 - KU.S.

MPKU.S. = 16 - KS.A.

A. Answer the questions below.

Once the agreement to permit up to $2 trillion of capital flows is in place, which way does the capital flow? (In other words, which country is the borrower and which country is the lender?)

With the capital controls, what is the rate of return on capital in the U.S.?

With the capital controls, what is the rate of return on capital in South Africa?

By limiting the capital flows to $2 trillion) is the world better off or worse off compared to the alternative of unrestricted capital flows? How much is the world better off or worse off?

By opening up the opportunity for $2 trillion of capital flows, is the world better off or worse off compared to the alternative of no capital flows? How much better off or worse off?

B. Now suppose negotiations between the U.S. and South Africa ultimately permit completely free capital flows, but that the U.S. decides to levy an annual tax of 3.0% on: (1) all U.S. capital invested in South Africa; and (2) all South African capital invested in the U.S. However, given that capital only flows one direction, one of these taxes will be relevant and the other one will not. Answer the questions in the table below.

After the agreement to permit free capital flows, and after the decision to levy the 3.0%, how much is the U.S. better off or worse off compared to the initial situation of no capital flows?

After the agreement to permit free capital flows, and after the U.S. decision to levy the 3.0% tax, how much is South Africa better off or worse off compared to the initial situation of no capital flows?

Suppose the U.S. decides to drop the 3.0% tax, but South Africa picks it up. In other words, there are no U.S. taxes on capital flows, but South Africa decides to levy an annual tax of 3.0% on (1) all South African capital invested in the U.S.; and (2) all U.S. capital invested in South Africa. How much is the U.S. better off or worse off, compared to the initial situation of no capital flows?

Once again, suppose the U.S. decides to drop the 3.0% tax, but South Africa picks it up. In other words, there are no U.S. taxes on capital flows, but South Africa decides to levy an annual tax of 3.0% on (1) all South African capital invested in the U.S.; and (2) all U.S. capital invested in South Africa. How much is South Africa better off or worse off, compared to the initial situation of no capital flows?

Reflecting on the four questions above, do you think policies regarding taxes on capital flows should be a subject of negotiation between the U.S. and South Africa?

Question 3. An investor is undertaking an investigation of purchasing power parity between the U.S., which uses the dollar as its currency, and Erehwon, which uses the lek as its currency. The table below gives information for the U.S. and Erehwon for 2016. Prices and money supplies are quoted in national currencies. The money demand constant represents the proportion of nominal income that is held as money. Real income is measured in bundles of output, which are identical in the U.S. and Erehwon.

|

|

Price of

Consumption Bundle

|

Money Supply,

Ms

|

Money Demand

Constant, k

|

Real Income,

Y

|

|

U.S.

|

12 dollars

|

unknown

|

1/2

|

200 billion

|

|

Erehwon

|

unknown

|

1.2 trillion feks

|

1/3

|

200 billion

|

A. There is missing information in the table above. What is the price of the consumption bundle in Erehwon? What is the money supply in the U.S.?

B. What is the purchasing power parity exchange rate, quoted as dollars per lek? If the actual exchange rate is $0.75/lek, is the lek overvalued or undervalued according to purchasing power parity?

C. Suppose a recession in Erehwon causes real income to decline 10% to 180 bundles. Unfortunately, the central bank in Erehwon does not change the money supply, and the money demand constant does not change either. Furthermore, nothing happens to the variables in the U.S. What is the new purchasing power parity exchange rate, again quoted as dollars per lek? Briefly explain whether the lek should depreciate or appreciate, and why.

Question 4. Suppose you are given the following financial information on January 1:

|

Spot $/£ exchange rate (e)

|

$1.25/£

|

|

1-year interest rate on dollars (iUS)

|

2.0%

|

|

1-year interest rate on pounds (iUK)

|

5.0%

|

|

Market's expected spot rate in one year (eex)

|

$1.23/£

|

A. If a U.K. investor is in agreement with the market's expected future spot rate, should he make an uncovered investment in dollars or simply invest in pounds?

B. If covered interest parity holds, what is the 1-year forward rate on January 1?

C. If a U.S. firm will be receiving £1,000,000 in one year, and wants to eliminate any foreign exchange risk using a forward contract, what should the firm do?

D. If a U.S. f will be receiving £1,000,000 in one year, and wants to eliminate any foreign exc\hange,risk but discovers that forward contracts are not available, what can the firm do in the money markets?

Question 5. Consider the spot market for the Korean won, as shown in the panel below.

A. There are proposals in the U.S. to change the corporate income tax by modifying the way it handles taxation of revenues on exports and the deductibility of expenses related-to imports: this is the "border adjustment tax." Some analysts conclude that there would be adiffect on the won/dollar exchange rate if the border adjustment tax goes into effect. Describe what might happen in the space below and show the effects in panel above.

B. Suppose the Bank of Korea (the central bank) pursues a fixed exchange rate regime at the initial exchange rate, eo. What will it need to do after the U.S. impleMents the border adjustment tax in ordirio maintainihis exchange rate? Describe what it needs to do in tie spacebelow and show the effects in the panel above.