Reference no: EM13718069

Question 1:

A European call option and put option on a stock both have a strike price of $50 and an expiration date in two months. Both sell for $5. The risk-free interest rate is 10% per annum, the current stock price is $55, and a $2 dividend is expected in one month. Identify the arbitrage opportunity open to a trader.

Clearly state what a trader would do to make a profit. What is the present value of the trader's profit?

Question 2:

A common stock will have a price of either $85 or $35 in 2 months. A two month put option on the stock has a strike price of $40.

Create a riskless portfolio. Buy one put option. How many shares should you buy?

Question 3:

Four put options on a stock have the same expiration date and strike prices of $55, $60, $65 and $70. The market prices are $5, $9, $13, and $18, respectively.

Explain how a condor can be created. Construct a table showing the profit from the strategy. For what range of stock prices would the condor lead to a loss?

|

Stock Price

|

Payoff

|

Profit

|

|

ST<

|

|

|

|

≤ ST<

|

|

|

|

≤ ST<

|

|

|

|

≤ ST<

|

|

|

|

≤ ST

|

|

|

Question 4:

Consider an option on a dividend-paying stock when the stock price is $48, the strike price is $45, the risk-free interest rate is 6% per annum, the volatility is 30% per annum, and the time to maturity is two months. The dividend to be paid in 1 month is $2.

a. What is the price of the option if it is a European call?

b. What is the price of the option if it is an American call?

Question 5:

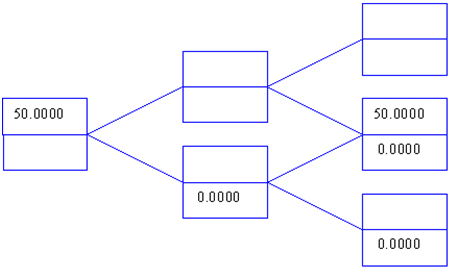

Consider a European call option on a non-dividend-paying stock where the stock price is $50, the strike price is $50, the risk-free rate is 5% per annum, the volatility is 25% per annum, and the time to maturity is four months.

a. Calculate u, d, a andp for a two-step tree. [Use 4 decimal places in your calculations.]

b. Value the option using a two-step tree. [Give your final answer to 2 decimal places.]

Question 6:

Suppose that the premium on a European put option, p = $3. The time to maturity, T = 1 year. The strike price is $20. The stock price of the underlying common stock is $12 today. The risk-free interest rate is 8% per annum. The stock does not pay dividends.

Observe that there is an arbitrage opportunity.

Clearly state what the trader would do to make a profit.

Question 7:

Consider the following portfolio: You buy two July 2009 maturity call options on Dell with exercise price of 30. You also sell two July 2009 maturity put options on Dell with an exercise price of 40. The Call premium is $3.30 and the Put premium is $2.50.

Assume each option contract is for one share of stock.

a. What will be your profit/loss on this position if Dell is selling at $42 on the option maturity date?

b. What will be your profit/loss on this position if Dell is selling at $38 on the option maturity date?

c. At what stock price on the option maturity date will you just break even on your investment?

Question 8:

Consider an option on a non-dividend-paying stock when the stock price is $48, the strike price is $45, the risk-free interest rate is 6% per annum, the volatility is 20% per annum, and the time to maturity is five months. It can be shown that d1 = .7576 and d2 = .6285.

Create a delta neutral portfolio of call options and stock. Short 10,000 call options (100 contracts). How many shares would you buy or sell?

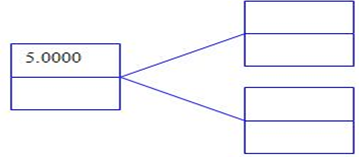

Question 9:

Consider an American put option on a stock. The stock price is $5, the strike price is $10, the risk-free rate is 4% per annum, u = 1.05, d = 0.9524, p = 0.5912, and the time to maturity is three months.

Value the option using a one-step tree. [Give your final answer to 2 decimal places.