Reference no: EM13183455

Capital Budgeting with Staged Entry Kereru Fisheries Ltd is a leading seafood fishing and processing company. The board of directors has scheduled a meeting in early 2012 to consider a significant change in corporate strategy. Kereru Fisheries Ltd's present strategy is to concentrate solely on fishing and processing seafood from the Tasman Sea and Marlborough Sounds/Cook Strait areas. The company's products include a variety of fish, crab, oysters, scallops, and mussels. The fish and shell-fish catch has dropped markedly however. This is due to over-fishing, a reduced quota allowance announced by the government in 2011, and increased competition from low-cost, foreign producers.

Kereru Fisheries Ltd's management has decided to reconsider the firm's strategic plan. The management is thinking of making a major move into the freshwater fish farming market - the government has just announced that it will allow the commercial farming of rainbow trout. Kereru Fisheries Ltd was founded by a consortium of commercial fishermen in Nelson in 1970. The founders planned to provide New Zealanders with fresh seafood. The company's products are considered high quality, and the firm is a leader in its chosen line. However, it has not fished for or processed freshwater fish. Rainbow trout has a reputation as a game fish. Kereru Fisheries Ltd believe that by packaging the product under its own name (which has an excellent reputation), using this reputation, and by utilising the company's marketing expertise, the effort will be financially successful. The company managers are examining a proposal for a two-step, strategic move into the rainbow trout market. Stage 1 calls for the construction of a number of fish ponds and a basic, no-frills processing plant of limited capacity. Stage 2 calls for the development of a major facility to house the fresh-fish processing division - research and development (R&D), processing, marketing, and general management.

Kereru Fisheries Ltd originally considered developing a major facility that would have an operational life of at least 10 years, but this would have required a much larger capital investment than stage 1. This idea was abandoned in favour of a staged-entry plan. To date, Kereru Fisheries Ltd has spent $3 million on R&D, including design and marketing studies, for the new facility. Of this amount, $500,000 has been expensed for tax purposes. The remaining $2.5 million has been capitalised and will be amortised over the 5- year operating life of stage 1. According to an Inland Revenue ruling specifically requested by Kereru Fisheries Ltd, capitalised R&D expenditures can be immediately expensed if the project is not undertaken.

If Kereru Fisheries Ltd decides to build the facility, it would require a 50 hectare site by December 31, 2012 (t = 0). The firm has decided to locate the facility in the MacKenzie basin of South Canterbury, because a year-round cold-water environment is required for the fish. The firm owns a suitable site on the Waitaki River, which is fed from snow melt and waters from Lake Tekapo. The land cost Kereru Fisheries Ltd $500,000 several years ago, but it can be sold for $2 million now, after all selling expenses have been deducted. Other suitable sites can also be purchased for $2 million. Kereru Fisheries Ltd can obtain an option on a similar site in the same area for $100,000 on December 31, 2012.

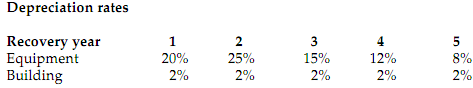

The option would give Kereru Fisheries Ltd the right to purchase the site for $2.6 million on December 31, 2017, when the firm will be considering stage 2 of the project. It is estimated that similar sites will then have a market value of $3 million. Most of 2013 would be spent obtaining Resource Management Act approvals for the project. The costs incurred would not be material to the decision. Construction would take place during 2014 at a cost of $8 million. For planning purposes, assume that the expenditure will occur on December 31, 2013. Kereru Fisheries Ltd can begin to depreciate the building in 2016 - the year the plant will go into service. Although its depreciable life is 50 years (see Table 1), the plant will be used for only 5 years, starting on January 1, 2016, with operating cash flows (end of year) occurring from December 31, 2016, through to December 31, 2020.

Kereru Fisheries Ltd estimates that the land will have a market value of $2.5 million at the end of 2020, and the building will have a market value of $3 million. The required processing equipment will be obtained and installed during 2015 at a cost of $12 million. (Assume that payment will have been made on December 31, 2014.) Depreciation on the equipment is as shown in Table 1. As with the building, tax depreciation will begin when operations commence, in 2016. At the end of 5 years, the wear and tear, along with technological obsolescence, means the equipment will be worth very little. The best estimate is $500,000.

Table 1 contains the depreciation schedules as developed by the firm's tax accountants. If Kereru Fisheries Ltd builds the stage 1 plant, the initial investment in net working capital will equal 25% of the estimated first-year sales. (Assume that this investment will be made on December 31, 2015.) Additions to net working capital in each subsequent year will be 25% of the dollar sales increase expected in the following year. For example, any additional net working capital required to support the projected increase in 2017 sales over 2016 sales will be paid for on December 31, 2016.

(a) For simplicity, these allowances have been rounded to the nearest one- tenth percent. (In actual applications, the allowances will not be rounded.)

(b) Since the plant is entering service on January 1, a full year's depreciation can be taken on the building in the first year. (In most situations, the first year's depreciation allowance on the building will be reduced because the allowance is based on the month that the property is placed in service.)

Kereru Fisheries Ltd's marketing department has projected wholesale sales of the rainbow trout at 10,000 tonnes for 2016. The sales price is expected to be set at $4,000 per tonne. The processing department has estimated variable costs to be 60% of sales. Fixed costs, excluding depreciation, are estimated at $9.5 million annually. Fixed costs, which include managerial salaries and property taxes but not depreciation, are expected to increase after 2016 at the rate of 4% per year. Unit sales are expected to increase at an annual rate of 10% as rainbow trout gains more market recognition and acceptance.

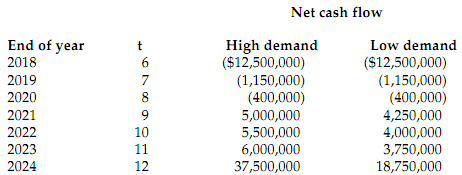

The sales price, however, is expected to remain flat due to increased competition in the rainbow trout market. Variable costs will remain at 60% of dollar sales, and, hence, will increase at the same rate as dollar sales, or 10%. If the company decides to go forward with the project, stage 2 will begin on December 31, 2018, when Kereru Fisheries Ltd has to spend $12.5 million on land, buildings, and equipment. Capital investment will continue for two more years, and the operating cash flows (end of year) will begin the year following the shutdown of the stage 1 plant. The stage 2 net cash flows are forecast in Table 2:

The net working capital from stage 1 will be transferred to stage 2 if it is undertaken. Stage 2 is projected to last beyond 2024, but cash flow estimation is so difficult when looking that far ahead that a terminal value, which incorporates the present value of all cash flows beyond 2024 (including salvage values and working capital), has been included in the 2024 cash flow. To simplify calculations, assume that Kereru Fisheries Ltd's tax rate is 30%. The firm's weighted average cost of capital is 10.0%, but Kereru Fisheries Ltd adjusts this amount up or down by 3 percentage points for projects with substantially more or less risk than average. Assume that you are the financial analyst charged with analysing the rainbow trout project. It is your job to evaluate the project and to prepare a recommendation for Kereru Fisheries Ltd's executive committee. In developing your recommendations, answer the following questions, posed by the chief financial officer, your immediate manager.

Questions 1. (a) In terms of the land acquisition for stage 1, what cost, if any, should be attributed to the rainbow trout project? Why?

(b) (i) If the currently owned site is used for this project, what should Kereru Fisheries Ltd do about its land needs for stage 2?

(ii) What discount rate would you use in analysing the option alternative? Why?

2. (a) (i) If the stage 1 project is not undertaken, how should you treat the R&D expenses? Calculate the tax savings in 2012.

(ii) If stage 1 is undertaken and the project goes ahead, how should you treat the R&D expenses?

(iii) Is there any opportunity cost if the firm undertakes the project? If so, calculate the benefit lost as a result.

(b) Describe how salvage values are taxed. Use the building's salvage value to illustrate your answer.

3. Determine stage 1's net cash flow from 2012 to 2020 (t0 - t8). Assume that the stage 1 project is judged as average risk. What are its stand-alone NPV, IRR, MIRR, and payback? Give your answers to at least one decimal place.

4. Now consider the expansion (stage 2) project.

(a) What are its stand alone NPV, IRR, and MIRR as of December 31, 2018 (t = 6), under each demand scenario? Show the NPV for today (t = 0).

(b) What is the expected NPV of stage 2, assuming there is an 80% probability that demand will be high during stage 2, but a 20% chance that demand will be low? Assume that stage 2 is an average- risk project.

5. Kereru Fisheries Ltd estimates that there is a 90% chance that stage 1 will meet all expectations and, consequently, that stage 2 will be undertaken. What is the expected NPV of Kereru Fisheries Ltd's rainbow trout project? Using Table 3 as a guide, construct a decision tree to help in your analysis.

6. What is the overall project's risk-adjusted NPV? (Hint: Use the percentage given in the question to adjust up or down to obtain the risk-adjusted discount rate. Use this to re-calculate the NPV, IRR, MIRR, payback period, and expected NPV as for Question 4 and 5.)

7. Consider all of the information obtained so far. What do you think Kereru Fisheries Ltd should do? Carefully justify your final conclusions. (Hint: Discuss the viability of the two stage process in this project, the suitability of the risk-adjusted discount rate and the possibility of using real options, such as abandonment or a timing option.)