Reference no: EM131198878

1. Exercises for Understanding Hedge Funds and Other Smart Money

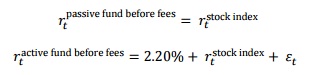

1.3. Hedge funds vs. mutual funds. Consider a passive mutual fund, an active mutual fund, and a hedge fund. The mutual funds claim to deliver the following gross returns:

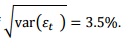

The passive fund charges an annual fee of 0.10%. The active mutual fund charges a fee of 1.20% and seeks to beat the same stock market index by about 1% per year after fees. The active mutual fund has a beta of 1 and has a tracking error volatility of

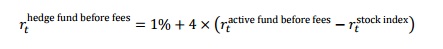

The hedge fund uses the same strategy as the active mutual fund to identify "good" and "bad" stocks, but implements the strategy as a long-short hedge fund, applying 4 times leverage. The risk-free interest rate is rf = 1% and the financing spread is zero (meaning that borrowing and lending rates are equal). Therefore, the hedge fund's return before fees is

a. What is the hedge fund's volatility?

b. What is the hedge fund's beta?

c. What is the hedge fund's alpha before fees (based on the mutual fund's alpha estimate)?

d. Suppose that an investor has $40 invested in the active fund and $60 in cash (measured in thousands, say). What investments in the passive fund, the hedge fund, and cash (i.e., the risk- free asset) would yield the same market exposure, same alpha, same volatility, and same exposure to εt ? As a result, what is the fair management fee for the hedge fund in the sense that it would make the investor indifferent between the two allocations (assume that the hedge fund charges a zero performance fee)?

e. If the hedge fund charges a management fee of 2%, what performance fee makes the expected fee the same as above? Ignore high water marks and ignore the fact that returns can be negative, but recall that performance fees are charged as a percentage of the (excess) return after management fees. Specifically, assume the performance fee is a fraction of the hedge fund's outperformance above the risk-free interest rate.

f. Comment on whether it is clear that hedge funds that charge 2-and-20 fees are "expensive" relative to typical mutual funds. More broadly, what should determine fees for active management?

|

What are the production costs of your economics class

: Corporate funeral giants have replaced small family-run funeral homes in many areas, in large part because of the lower costs they achieve. What kind of economies of scale exist in the funeral business? Why doesn't someone build one colossal funer..

|

|

In how many hours will they be 4400 miles apart

: Two planes leave JFK airport at the same time, one flying north at 500 mph and the other south at 600 mph. In how many hours will they be 4400 miles apart?

|

|

Calculating power of excel

: Within these instructions, students are introduced to the math operations and calculating power of Excel. We pick up where we ended in the "organization" instructions

|

|

How this charge is an example of the price system at work

: Given that revenues from these congestion charges are invested in the city's transport system, how will this affect the charge level holding all other variables constant?

|

|

What is the fair management fee for the hedge fund

: What is the fair management fee for the hedge fund in the sense that it would make the investor indifferent between the two allocations (assume that the hedge fund charges a zero performance fee)?

|

|

What would a carpenter do in a similar situation

: Suppose, as an economist, you are asked to analyze an issue unlike anything you have ever done before. Also, suppose you do not have a specific model for analyzing that issue. What should you do? Hint: What would a carpenter do in a similar situat..

|

|

Analyze integrated marketing communications

: Develop strategies to assess performance and achieve marketing goals. Develop pricing strategies and distribution channels for products. Analyze integrated marketing communications and its relationship to advertising strategy.

|

|

What price would you bid if you must win the project

: Defend your answers with discussion, making any assumptions you feel are reasonable and/or are supported by the information provided.

|

|

Develop a swot analysis of a art software

: Develop a SWOT analysis of a art software geared towards students in K-12. The software develops as the students move along within their grade.

|