Reference no: EM13682

Question

If the beta of Exxon Mobil is 0.65, risk-free rate is 4% and the market rate of return is 14%, evaluate the expected rate of return for Exxon.

Question

Given the following data for the a stock: risk-free rate = 5%; beta (market) = 1.5; beta (size) = 0.3; beta (book-to-market) = 1.1; market risk premium = 7%; size risk premium = 3.7%; and book-to-market risk premium = 5.2%. evaluate the expected return on the stock using the Fama-French three-factor model.

Question

Johnson Paint stock has an expected return of 19% with a beta of 1.7, while Williamson Tire stock has an expected return of 14% with a beta of 1.2. Assume the CAMP is true.

(a). What is the expected return on the market?

(b). What is the risk-free rate?

(c). What is the market risk premium?

Question

The market value of Charcoal Corporation's common stock is $20 million, and the market value of its risk-free debt is $5 million. The beta of the company's common stock is 1.25, and the market return (Km) is 13%. If the Treasury bill rate (Rf) is 5%, what is the company's cost of capital? (Assume no taxes.)

Question

A project has an expected risky cash flow of $300, in year 3. The risk-free rate is 5%, the market risk premium is 8% and the project's beta is 1.25. evaluate the certainty equivalent cash flow for year 3.

Question

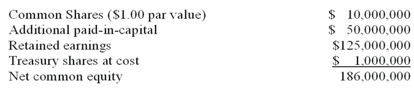

The equity accounts of Bio-Tech Company is as follows:

Suppose the firm sells 2,000,000 new (additional) shares at a price of $19 per share. What is the new value of Common Shares account? What is the new value of the additional paid-in-capital account?

Question

Given the following data for U&P Company: Debt (D) = $100 million; Equity (E) = $300 Million; rD = 6%; rE = 12% and TC = 30%. evaluate the after-tax weighted average cost of capital (WACC):

Question

Learn and Earn Company is financed entirely by Common stock that is priced to offer a 20% expected return. If the company repurchases 50% of the stock and substitutes an equal value of debt yielding 8%, what is the expected return on the common stock after refinancing?

Question

Consider two firms, With and Without, that have identical assets that generate identical cash flows. Without is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. With has 2 million shares outstanding and $12 million dollars in debt at an interest rate of 5%. According to MM Proposition 1, what is the stock price for With?

Question

Consider a one-year, $1000, zero-coupon bond issued. Assume that the bond payoffs are uncertain. There is a 50% chance that the bond will repay its face value in full and a 50% chance that the bond will default and you will receive $900. Thus, you would expect to receive $950.Because of the uncertainty, the discount rate is 5.9%.evaluate the promised yield on the bond.