Reference no: EM131393906

Assignment: Simulation

Part 1: Market Timing

This question explores uncertainty in investing. Assume you plan to invest in a broad-based equity index. You start with a zero balance account. Each year, you plan to contribute an extra $1O,OOO at year-end. (Assume annual compounding and uncorrelated market returns from year to year.)

a. If you invest (and contribute) for 3O years and the equity index return each year is normally distributed with expected return of 1O% and standard deviation 2O% (i.e., a different realized return each year), what is the expected value of your investment account in 3O years (just after your last payment)?

b. What is the likelihood that you end up with less than $6OO,OOO in 3O years (i.e., twice what you contributed)?

c. How does the expected balance and likelihood change if you move your money to cash in years where the realized index return in the previous year was negative? (Note: You still make a contribution to your account every year, but your allocation to the market is zero in years where the prior year realized market return was negative.)

d. Let's explore the assumption of uncorrelated market returns. The accompanying spreadsheet provides annual realized market excess returns. Run the following regression of current year returns on last-year returns (you'll need to lag the returns one year to form the x-variable):

Rtmkt = a + ρRt-1mkt + ε

What is the estimate and t-statistic for the coefficient ρ? What is the estimate and t- statistic for the intercept a? Please interpret both economically and statistically.

Part 2: Option Pricing

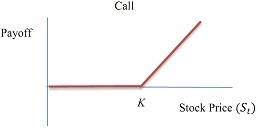

With Risk, we now have the tools to price derivatives. Recall that a call option is the right, but not the obligation, to buy a stock at a predetermined strike price K. The payoff of a call option as a function of the stock price at maturity is max(St - K, 0):

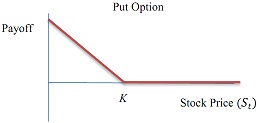

Similarly, a put option is the right, but not the obligation, to sell a stock at a predetermined strike price K. The put option payoff as a function of the stock price at maturity is max(K - St, 0):

In this question, we will simulate stock prices and find the values of call and put options using simulation and using the Black-Scholes formula. A common way to simulate stock prices is by assuming future stock prices are log-normal. In particular, the (random) future stock price is:

St = S0exp[(rf - 0.5σ2) ⋅ t + σ√t ⋅ z ]

where rf is the risk-free rate, t is the time to maturity of the option (expressed in years), and σ is the annual volatility. z is a standard normal variable, and this will be the source of randomness in the model.

a. The first step in the model is to draw z using RiskNormal(0,1).

b. Using Risk, create a formula that calculates a random future stock price 3 months in the future (t=0.25 years) using the expression above and the parameters in the accompanying spreadsheet. Define this cell as an Risk output.

c. A call option pays off only if the stock price at maturity is greater than the strike price, K. Its payoff function is: max(St - K, 0). Create a cell with the call option payoff formula in 3-month's time and define this as an Risk output.

d. A put option pays off only if the stock price at maturity is less than the strike price, K. Its payoff function is: max(K - St, 0). Create a cell with the put option payoff formula in 3- month's time and define this as an Risk output.

Simulate the future stock price using 5000 iterations.

e. What is the probability that the future stock price is above the strike price (i.e., the call option is in the money)?

f. Paste images of the distributions of the future stock price, the call payoff, and the put payoff.

g. What is the expected payoff of the call at maturity?

h. Calculate the current call price by discounting the average future call payoff (its expected value) to the present at the risk-free rate:

Call0= exp(-rf ⋅ t) ⋅ Expected Future Call Value

i. What is the expected payoff of the put at maturity?

j. Calculate the current put price by discounting the average future put payoff (its expected value) to the present at the risk-free rate:

Put0 = exp(-rf ⋅ t) ⋅ Expected Future Put Value

Now let's calculate the Black-Scholes call price. The Black-Scholes formula for a call option is:

Call0 = S0N(d1) - K ⋅ exp(-rf ⋅ t) N(d2)

where d1 = [In (S0/K) + (rf + 0.5 ⋅ σ2) ⋅ t]⁄σ√t and d2 = d1 - σ√t. N(⋅) denotes the normal

cumulative distribution, which can be evaluated in Excel using the NORM.S.DIST(⋅,1) function. Similarly, the Black-Scholes formula for a put option is:

PutO = ?? ⋅ exp(-rf ⋅ t) N(-d2) - SON(-d1)

k. What are the Black-Scholes call and put prices? How do they compare to the call and option prices calculated from simulated stock prices?

l. What is the value of N(d2)? How does it compare to the probability that the simulated stock price is above the strike price (from (e))?